Wall Street Divided: Gains on Apple and Eli Lilly News, Rate Worries Remain

Trading on U.S. stock markets ended in disarray on Thursday, with positive news from tech giants and pharma companies colliding with interest rate concerns. Market participants wavered between hopes for progress in international negotiations and worrying signs from the healthcare sector.

Hopes for a Japan, China Deal Stimulate Risk Appetite

Investors were cautiously optimistic after US President Donald Trump said "significant progress" had been made in talks with Japan. The words were a relief after a volatile environment that saw markets plunge.

Trump also expressed confidence that a deal could be reached with China. While specifics were lacking, even the hint of easing trade tensions between the two economic giants was an encouraging sign for traders.

Eli Lilly Soars as New Pill Shows Impressive Results

The real catalyst for optimism was pharmaceutical company Eli Lilly. Its shares soared 14% after the release of clinical trial results showing that its experimental drug was as effective as the popular Ozempic in reducing weight and blood sugar levels in diabetics – a major step forward for the company.

Apple Recovers from Fall

Apple was not left out either. Its shares rose by 1.4%, having recovered some of their previous losses. The recovery in the value of the tech giant's shares gave an additional boost to the market, especially in light of expectations of new product announcements and steady demand for the iPhone.

The other side of the coin: UnitedHealth is dragging the index down

However, not all companies were able to please investors. Shares of the insurer UnitedHealth fell by 22% after the company reduced its annual profit forecast. The reason is the expected high medical costs in the second half of the year. This decline was a significant blow to the Dow Jones index, which ended up in the "red zone".

A wave of negativity in the insurance sector

The fall of UnitedHealth provoked a chain reaction in the industry. Shares of CVS Health fell by almost 2%, and Humana shares fell by 7.4%. Strong shocks in the medical sector somewhat overshadowed encouraging news from other market segments.

Modest growth and deep drawdowns: how the day ended on Wall Street

The US stock market closed on Thursday with mixed results. The S&P 500 index managed to add a symbolic 0.13%, ending the session at 5282.70 points. Meanwhile, the high-tech Nasdaq slightly fell by 0.13% to 16,286.45, and the Dow Jones industrial index suffered a significant loss - minus 1.33%, finishing at 39,142.23 points.

Energy and consumer sector are the leaders of growth

Despite the general uncertainty, most sectors within the S&P 500 were able to show positive dynamics: growth was recorded in eight out of eleven sectors. Energy led the way, rising 2.3%, helped by higher oil prices and optimism around global demand. Consumer staples followed with a 2.2% gain, a solid move especially in a volatile environment.

Trump Tariffs Back in Focus: Investors on Tension

The stock market continues to react to former President Donald Trump's sharp trade policy reversals. Tensions are mounting over his controversial stance on tariffs, with his recent announcement of sweeping tariffs and subsequent partial repeal throwing investors into disarray. It's a seesaw that's hard for the market to balance.

Netflix Offers Hope: Streaming Giant Pleases Investors

There are some positives amid the general instability. Netflix shares rose 2.5% in extended trading after reporting a quarterly report that beat analysts' expectations. The company's management also provided an encouraging revenue forecast, which immediately increased investor interest in the streaming business.

Trump again against the Fed: Powell is expected to be fired soon

Former US President Donald Trump has once again taken up criticism of Federal Reserve Chairman Jerome Powell — and this time especially harshly. In his statement on social media on Thursday, he made it clear that he considers the dismissal of the Fed Chairman a matter of urgency. At the same time, he insists on lowering the key interest rate, calling on the regulator to loosen monetary policy.

Such public pressure from Trump causes a mixed reaction in the markets: some are hoping for stimulus, others are afraid of the politicization of the Fed.

Unemployment is not growing, but there is no smell of growth either

While some indicators are alarming, others remain stable. New data from the US Department of Labor indicate a decrease in the number of applications for unemployment benefits. This may indicate the strength of the labor market, at least for now. However, companies facing uncertainty due to possible new tariffs are being cautious in hiring — no one wants to rush in an environment of increased volatility.

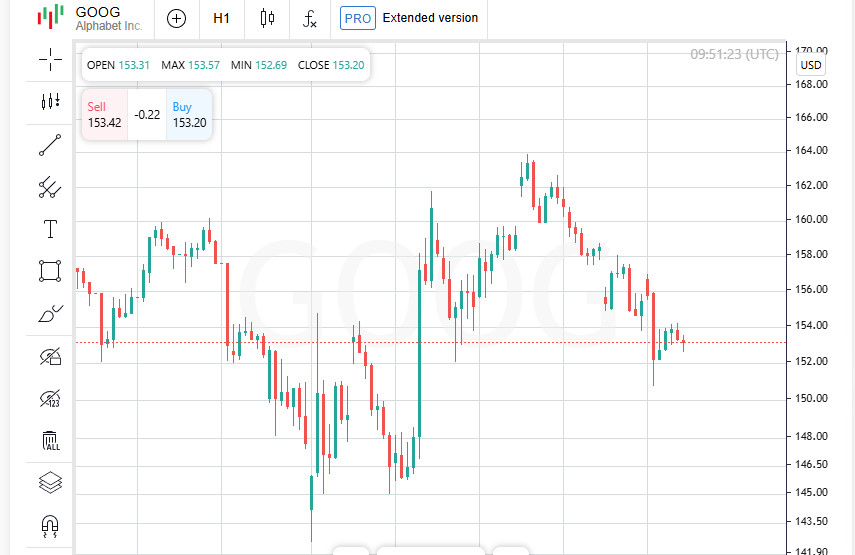

Google Under Attack: Court Rules Dominance Illegal

Shares in Google's parent company Alphabet fell 1.4% after a federal court ruled that the tech giant was abusing its position in online advertising markets by controlling two segments at once. The ruling could have far-reaching implications for the company and the entire US advertising and tech sectors.

East Brings Hope: Japan's Nikkei at Quarterly High

While US markets are sliding down, the Japanese stock exchange is showing confident growth. The Nikkei index added 1% on Friday and ended the week with its best result in the last three months. The reason is the strengthening hopes for reaching trade agreements between the US and key partners, including Japan. Trump's statements about progress in the negotiations inspire investors with confidence that tensions can ease, and this opens a window of opportunity for Asian economies.

Japan in Focus: US Deal Takes Center Stage

In parallel, direct negotiations between Japan and the US began in Washington. Economy Minister Resei Akazawa reported that Trump called the agreement with Japan a "top priority." On social media, the former US president added that the negotiations were going well, summing up succinctly: "Great progress!"

This diplomatic tone, coupled with the revitalization of the negotiating process, has spurred risk appetite on Asian markets.

Pharmaceuticals on the Rise: Chugai is the Star of the Day

Against the backdrop of the overall growth of the Japanese market, the pharmaceutical sector showed itself especially brightly. It became the leader of the day, adding an impressive 4.68%. The main driver was the jump in Chugai Pharmaceutical shares, which soared by 17.54% after news of successful trials of their obesity drug, created jointly with Eli Lilly. The news inspired investors to actively buy, strengthening the sector's position.

Shipping on a positive wave

The shipping industry also moved steadily upward: growth amounted to 2.92%, making it the second-best performer among the 33 industrial groups of the Tokyo Stock Exchange. Investors continue to bet on the recovery of global logistics and demand for transportation.

Tech stumbled: chip makers' shares went into the red

However, not all sectors supported the rally. The semiconductor sector went against the trend: after a small rebound the day before, investors began to take profits. As a result, Advantest shares lost 2.26%, and Screen Holdings fell by 3.97%, becoming the outsiders of the day in the Nikkei. The weakening interest in chips may be due to uncertainty in global demand and fluctuations in the technology supply chains.