Cryptocurrency is an asset often used for investments and generating income. However, before using digital money, it's important to realize their highly unstable value, which can spike by 200% in a single trading session and then immediately plummet by 300%. The same can happen in the opposite direction.

We also recommend reading “The ins and outs of cryptocurrency.”

Such quicksilver changes in market quotes of cryptocurrencies, which resemble a leaf bending under even the slightest breeze, are called cryptocurrency volatility.

In this article, we will explain why cryptocurrencies have such an unstable value, what factors influence them, which crypto assets are most prone to price fluctuations, and why it’s so crucial to closely monitor this unpredictable indicator.

Idea of volatility

This concept refers to variability. It indicates how much the price of an asset (and not necessarily a cryptocurrency) changes over a certain period.

When it comes to cryptocurrencies, their volatility is much higher than that of fiat currencies (such as the US dollar, euro, pound sterling, ruble, etc.) or securities (stocks).

The high volatility of cryptocurrencies is a unique feature that gives investors a chance to either make significant profits or lose part or all of their investments. You can get rich or go bankrupt simply due to a sharp price change, which may happen because of a piece of news or unverified rumors.

The higher the volatility, the higher the risk of losses. This principle also works the other way around: the higher the volatility, the greater the chances of making substantial money.

There are two main categories of volatility:

Historical 2. Determined by how far it deviates from its initial value over a given time period. | Projected This is the expectation of future price movements (forecast). |

A vivid example of high cryptocurrency volatility is the price of the main digital asset—Bitcoin. From December 2017 to December 2018, its price rose to $19,483, then dropped by over 80%. In November 2021, the price skyrocketed to $69,000 (an all-time high), but by October 2022, it had slumped again, this time to $15,880. Today, Bitcoin is trading at about $64,000.

Cryptocurrency vs. stock volatility: what is difference?

On the global stock market, volatility depends on the sector to which the asset belongs and its type. The principle is this: the higher the asset’s capitalization, the more stable its price will be.

For example, shares of the largest companies (like Apple, Berkshire Hathaway, etc.) are always relatively stable in price. On the other hand, small "penny" stocks almost always experience sharp price fluctuations. Bonds, in contrast, are characterized by very low volatility and minor fluctuations.

Bitcoin and other popular cryptocurrencies undergo significant upward and downward movements on the charts, often in very short periods. Below, we will explain why this happens and what influences it.

What influences volatility?

In this section, we will break down all the main reasons behind cryptocurrency volatility and why their prices often experience sharp fluctuations on technical charts.

Lack of ties to real value

Cryptocurrencies are not backed by tangible assets, which sets them apart from fiat currencies, whose value is supported by either precious metals or other material resources (such as oil or gas).

The price of cryptocurrencies is determined by demand, which differentiates them sharply from other digital assets—stablecoins. The latter are backed by fiat currencies, resulting in much lower volatility compared to standard cryptocurrencies.

Supply and demand

The price of cryptocurrencies largely depends on the amount in circulation. New coins are issued through mining and staking, which affects the balance of supply and demand.

For example, Bitcoin’s supply is capped at 21 million coins, and every Bitcoin bought or sold impacts its price. The more coins in circulation, the lower the price, and the opposite is also true. This pricing principle applies not only to cryptocurrencies but also to securities and other financial instruments in the global market.

Cryptocurrency volatility arises when large volumes of an asset are traded in the market.

Speculation and hype

Speculative hype is another factor that increases volatility. New cryptocurrencies always attract the attention of investors and various traders, triggering sharp price movements. When a coin becomes overvalued, its price starts to fall, ultimately leading to losses.

Various speculations and hype surrounding a cryptocurrency often cause significant price spikes followed by subsequent drops.

It’s also worth noting the influence of celebrities on cryptocurrency prices. For instance, Elon Musk’s tweets frequently cause spikes in the price of the meme cryptocurrency Dogecoin. Each time Musk mentions the coin, its value begins to rise.

Celebrities are often eager to sign deals with cryptocurrency startups, becoming the brand ambassador for a coin. Influencers help new coins gain value, even if it’s only due to a sharp (albeit unjustified) surge in demand. Examples of such celebrities include Steven Seagal and Akon.

Dependence on news

The cryptocurrency market reacts sharply to any news, forecasts, and media or social media publications. What’s particularly interesting is that even unconfirmed information can cause significant price fluctuations, which even seasoned analysts may not anticipate. Therefore, it’s safe to say that the cryptocurrency market is highly susceptible to various news triggers.

Market emotions

The emotional component is one of the main factors driving cryptocurrency volatility. The digital coin market is relatively young, and its prices are clearly not yet stabilized, unlike the stock market, where everything is more established and predictable. The search for a “healthy” and justified market price is still ongoing.

Mining costs

Miners also significantly impact cryptocurrency price fluctuations. The cost of mining depends on the hash rate and energy consumption. In Proof-of-Work networks, miners compete for rewards, and high competition significantly increases both the complexity and cost of mining.

If mining costs at some point exceed revenue, miners will start to switch to other cryptocurrencies en masse, which will trigger volatility, albeit short-term.

Competition

Today, there is an overwhelming variety of cryptocurrencies and blockchains. Every day, new crypto projects are launched with remarkable regularity. This fierce competition puts enormous pressure on the value of all existing cryptocurrencies, including the industry’s flagship, Bitcoin, and its main competitor, Ethereum.

Lack of regulation

Cryptocurrencies are unique in that they currently exist in a "gray zone" in most countries, which undoubtedly reduces investor confidence and increases price sensitivity. Although many jurisdictions are actively trying to legalize and regulate cryptocurrencies, they remain beyond the control of any government financial authorities.

This lack of regulation allows experienced traders and speculators to skillfully manipulate the crypto market. This is often done by placing orders with the intent of canceling them later. In regulated markets, such fake orders are illegal and punishable.

The presence of fake orders leads to a false perception of market behavior, which can cause sharp fluctuations in cryptocurrency prices and complete unpredictability.

Market volatility

Although cryptocurrencies are becoming more familiar as a means of payment (even in a "gray" zone) and as an instrument for saving and increasing capital, they remain a relatively new and uncertain phenomenon. The cryptocurrency market is still in the formation stage and has a relatively small user base. This uncertainty and lack of a majority user base lead to the sharp price fluctuations of crypto assets.

Crypto whales

"Whales" refer to large holders of cryptocurrencies who can influence the entire crypto market through their large-scale purchases or sales (we're talking about significant volumes of crypto assets).

For example, if the owner of one of the largest Bitcoin wallets suddenly decides to sell part of their Bitcoin holdings, it could significantly change the value not only of Bitcoin but of the entire market.

Volatility is cyclical

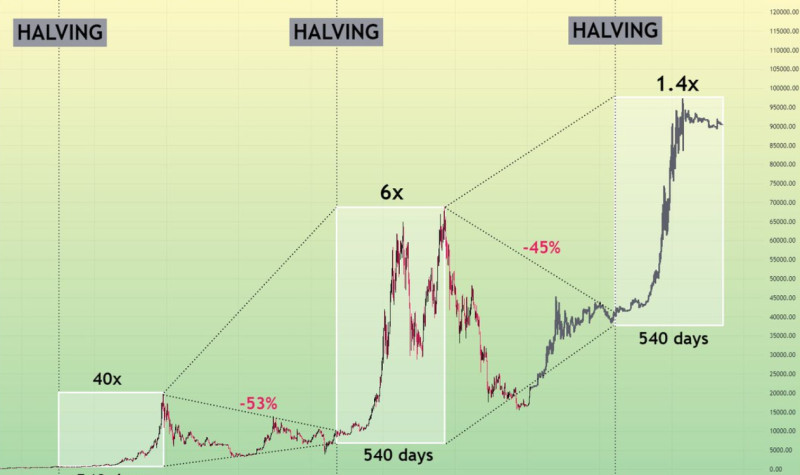

The volatility of certain cryptocurrencies is cyclical and often associated with halving events. Halving means the periodic reduction in the number of newly issued coins distributed among miners.

Halving is coded into Bitcoin to ensure that the total supply never exceeds 21 million units. Here’s an example of how Bitcoin halving affects its price:

- After the first halving, Bitcoin's price was around $11, then it surged to $1,100 before crashing back down to $200.

- During the second halving, Bitcoin traded around $600, rose to nearly $20,000, and then dropped to $3,500.

- The third halving saw Bitcoin at $8,500, and 1.5 years later, it reached a new high of $69,000, followed by another decline.

The cyclical nature of Bitcoin's volatility offers traders an excellent opportunity to profit by predicting price changes. In this context, high volatility can sometimes be considered a positive factor.

Monitoring volatility

Cryptocurrency volatility is a key factor that helps investors assess all existing risks. It's clear that investors are often willing to take on higher risks if they perceive a greater chance of significant profits, meaning they accept that potential losses may be justified. Typically, diversifying investments reduces risks significantly.

The trading volume of Bitcoin and the involvement of institutional investors tend to reduce its volatility, while cryptocurrencies with lower trading volumes are usually more volatile. If you choose to invest in these assets, be prepared to lose part of your funds.

Accurately assessing potential losses is the main reason to monitor asset volatility.

Given the heightened volatility of the entire cryptocurrency market, it’s always wise to follow some basic trading safety rules:

- Invest in a variety of cryptocurrencies and shape a diversified portfolio (the currencies in your portfolio should be from different projects, sectors, and have varying levels of risk).

- Track halving events for the coins you've invested in, as prices usually rise after halving.

- Follow news and forecasts in the crypto world to react promptly to sharp fluctuations.

- Only invest amounts you are comfortable losing.

Role of volatility in trading

The most volatile assets attract traders who seek high profits and are not afraid of high risks.

Cryptocurrency volatility is its defining feature. Significant and unexpected price swings, coupled with high liquidity, attract many traders, especially scalpers. This characteristic creates both demand and potential for speculation, further intensifying cryptocurrency volatility.

Traders and investors who play the long game tend to prefer less volatile markets, investing in proven stocks, profitable indices, and various ETFs. Long-term investments are appealing due to their stability and predictability.

Stocks are tied to the companies that issue them and are dependent on the global economy. Therefore, the high volatility of some stocks is not welcome, as it could have negative effects on the global economy.

Cryptocurrencies, on the other hand, are not physically backed by anything, which makes them a frequent tool for hedging and speculation. Many tokens are supported by the projects that issue them, but these projects often remain confined to their blockchain space. For this reason, cryptocurrencies can experience sharp rises and falls without any aftermath for the global economy.

Crypto Volatility Index (CVI)

The cryptocurrency market has its own version of the VIX index—a decentralized project called the Crypto Volatility Index (CVI).

The CVI index is a forecast of cryptocurrency volatility for the next 30 days. It includes a decentralized trading platform where users can open and close trading positions using cryptocurrency wallets like MetaMask, Trust Wallet, or others.

Volatility indicators

There are useful indicators that signal upcoming increases or decreases in market fluctuations. These indicators include:

- Bollinger Bands

- Ichimoku Cloud

- Keltner Channel

- Relative Volatility

- Historical Volatility

- Donchian Channels

- Standard Deviation

- Chaikin Volatility

Most volatile cryptocurrencies

Here’s a list of cryptocurrencies that are known for their notable volatility, displaying the highest degrees of price fluctuations:

- Bitcoin

This is the first and most volatile cryptocurrency in the market, characterized by sharp rises and falls. Importantly, in recent years, Bitcoin’s volatility has decreased, but we’ll discuss that further below. - Litecoin

A Bitcoin fork launched in 2011, Litecoin has experienced periods of significant volatility—up to 47%. Currently, Litecoin shows relative stability, with average price movements of 2–4% within 24 hours. - Ethereum

The second-largest cryptocurrency by popularity and market capitalization after Bitcoin. Ethereum's price has seen significant fluctuations, moving up to 17% in just a few days. Today, similar to Bitcoin, its volatility is at a relatively low level—just 37% over 90 days. - Solana

This cryptocurrency saw its peak volatility in 2021–2022. The highest volatility occurred in the fall of 2021, with swings reaching 80%, while in 2022, it recorded 70%. Today, Solana’s price movements are within the range of 11–13%. - Dogecoin

This meme cryptocurrency had its highest volatility index at the beginning of 2021, reaching a staggering 175%. However, in the fall of 2023, the token unexpectedly began to show more stability, with only 4–6% price swings.

Why Bitcoin’s volatility declines

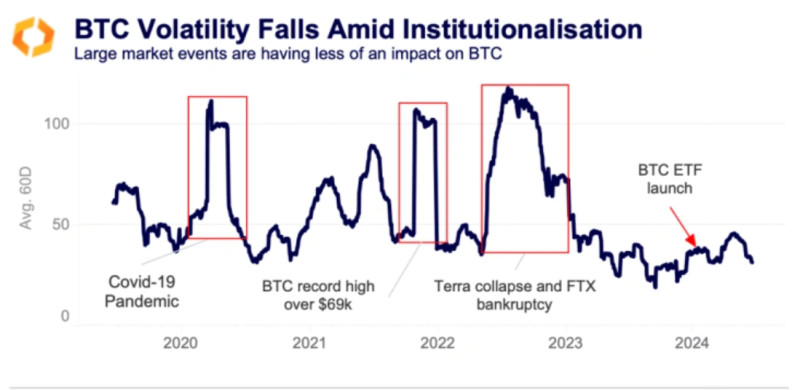

As mentioned earlier, Bitcoin’s volatility has significantly decreased compared to previous market cycles.

The main factor contributing to this is the gradual increase in trading activity by US traders.

The chart above shows the clear impact of major market events on Bitcoin's price movements from 2020 to 2024.

The beginning of 2020 was marked by a sharp rise in Bitcoin’s volatility, driven by the COVID-19 pandemic. The main cryptocurrency’s instability peaked in March of the same year.

In November 2021, Bitcoin’s price climbed to $69,000. In November 2022, the sudden bankruptcy of the leading crypto exchange FTX triggered another surge in volatility.

Our chart shows that Bitcoin’s volatility during these periods far exceeded the level seen after the launch of spot Bitcoin ETFs in the US and Bitcoin’s new all-time high in April.

When Bitcoin hit an all-time high of $74,000 in early 2024, its volatility was 40%. Interestingly, this level was much lower than in 2021, when volatility reached 106%. Surprisingly, even such a significant and long-awaited event as the launch of spot Bitcoin ETFs in the US had a minimal effect on price movements.

Undoubtedly, Bitcoin has reached a new phase in 2024, which can be characterized as maturity. This is evidenced by the clear reduction in its price fluctuations: since the beginning of 2023, Bitcoin’s 60-day price movement has been just under 50%, a stark contrast to the sharp swings in 2022 when volatility exceeded 100%.

What level of cryptocurrency volatility expected ahead?

In 2020, the stablecoin Tether (USDT) became the leader in daily trading volume, thanks to its peg to the US dollar. Since then, it has maintained its dominant position. Even during major market shocks, USDT’s trading volume far exceeds that of Bitcoin. For example, during the FTX exchange collapse in the fall of 2022, USDT’s daily trading volume reached $140 billion, while Bitcoin’s was no more than $100 billion.

Besides, central bank digital currencies (CBDCs) are actively being introduced in various countries, with volatility expected to align with fiat currencies (USD, EUR, GBP, CNY, etc.). China has already successfully integrated its official digital yuan (DCEP) into its economy. The US, UK, Japan, and many other developed countries are working on perfecting their own CBDC projects.

Despite the high volatility of cryptocurrencies, the market continues to grow at a rapid pace, as it did a year and even five years ago.

Many countries are rethinking their initially skeptical stance on cryptocurrencies, developing and implementing various regulatory mechanisms. Prominent media figures, TV hosts, singers, actors, and bloggers are increasingly investing in cryptocurrencies and supporting new crypto projects.

All these factors point to the gradual development of the cryptocurrency market, which could eventually lead to its stabilization and a reduction in volatility. However, when exactly and to what extent this will happen remains difficult to predict.

Conclusion

Cryptocurrency volatility is one of the main characteristics of the digital world, which must always be considered when planning investments in such assets. Cryptocurrency prices are unstable, and any minor news trigger can easily cause price fluctuations.

The sharp and often unpredictable swings in the value of digital assets can provide a unique opportunity for easy profit or lead to significant, sometimes substantial, losses.

These abrupt and systematic price fluctuations are due to the lack of clear government regulation, the absence of real backing, the relative novelty of the crypto market, and its extreme sensitivity to news, triggers, and even rumors.

Potential risks can be mitigated through competent investing, close attention to the state of the cryptocurrency market, and being prepared to make quick and confident decisions in the face of any unexpected changes or circumstances.

Back to articles

Back to articles