The cryptocurrency industry has opened up new earning opportunities, including passive income options. In addition to making profits through active trading on crypto exchanges, you can also earn passively in a fun and engaging way — through crypto lending.

If you own cryptocurrency that you are not planning to sell anytime soon, you can put it to work by investing it in other users’ projects. The process is usually quite simple: you choose a project that interests you, review the investment terms, and if everything looks good, you invest. After a certain period, you begin earning a steady income in the form of interest payments.

This earning method is not entirely passive, as it still requires you to take some action. You will need to research, analyze, and assess available platforms offering lending options while also keeping an eye on the current market situation. In short, crypto lending is not about doing nothing but it is also far from being a full-time job.

When compared to traditional bank deposits, crypto lending offers significantly more advantages, including higher returns and more flexible conditions.

That is precisely why crypto lending has become one of the most popular methods of growing capital passively. In fact, it is often regarded as one of the best options available.

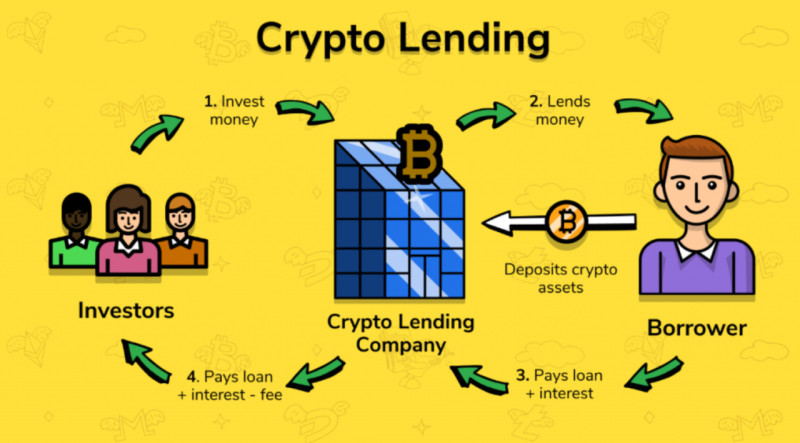

At its core, crypto lending is the process of lending your digital assets to other users (or even to platforms) in exchange for interest. It is almost identical to traditional lending, with the key difference being that the entire process is carried out using cryptocurrencies, which introduces a set of unique features and considerations.

In this article, we will take a closer look at how crypto lending works, how you can earn from it, and who it is best suited for. We will explore the different types of lending, the platforms where it is offered, the cryptocurrencies suitable for lending, and the exchanges that support it. We will also discuss a notable crypto project: BitConnect.

What crypto lending is and how it works

The concept of earning a profit through lending emerged alongside the evolution of electronic payment systems. However, this method experienced rapid development and diversification with the rise and widespread adoption of cryptocurrencies. Today, crypto lending is primarily carried out through blockchain-based projects or cryptocurrency exchanges.

Simply put, crypto lending is the process of renting out your digital assets to others. In essence, you are “loaning” your cryptocurrency to other users or platforms in exchange for a specific interest rate.

Also read: Basics of cryptocurrencies

If you have purchased or already hold some unused coins, you can lend them out. The borrower can use your assets for their own purposes but must return them within a specified period.

This way, your crypto starts “working” for you instead of sitting idle in your wallet. It generates income without needing to be sold.

Crypto lending allows you to put your coins to work and earn passive income through interest payments.

However, it is important to understand that lending carries a high level of risk. That said, we believe many of the risks can be offset by the potentially high returns. Yes, you are taking a risk, but that risk might pay off handsomely.

Still, it is crucial to approach crypto lending with careful analysis. Do not chase easy money. Always weigh the pros and cons before making a decision.

Given the risk involved, you should only invest amounts that you can afford to lose without affecting your financial stability or peace of mind.

While crypto lending platforms often offer automated tools and bots that operate according to predefined strategies, in volatile market conditions, these tools can lead to both gains and losses.

Additionally, some platforms allow you to lend directly to real entrepreneurs at interest, much like traditional bank loans.

There are two essential rules every investor should follow to make crypto lending profitable:

1. Choose your lending platform carefully. The risk of falling victim to scammers is significant in this space.

2. Not all digital assets have sufficient liquidity. Illiquid tokens may be difficult to trade or retrieve in the future.

You can lend your cryptocurrency on exchanges, through specialized lending platforms, or by investing in crypto projects that support native lending features.

Crypto lending typically comes with the following terms:

1. No minimum deposit is required.

2. Lending periods range from 30 days to 1 year.

3. Interest rates vary: around 1% per month on crypto exchanges and up to 1% per day on lending platforms.

4. Transaction fees typically range from 0.2% to 1% of the total deal amount.

Keep in mind: cryptocurrency exchanges are generally more reliable than third-party lending platforms. Exchanges value their reputation and enforce strict identity verification procedures to ensure security and trustworthiness.

How to earn with crypto lending

Getting started with crypto lending and earning from it requires just three simple steps:

1. Choose a platform.

Select a crypto exchange or dedicated lending platform that offers favorable terms and has a solid reputation. This is a crucial decision, as the reliability of the platform directly affects your investment’s safety.

2. Register.

The registration process is usually straightforward. Most platforms will ask you to provide personal information and submit scanned documents for identity verification.

3. Submit your lending request.

Once registered, you can deposit your digital assets to the platform according to its rules.

From there, your job is simply to wait until the lending period ends. Once it does, your cryptocurrency will be returned to you, along with the interest earned. That is your passive profit.

It is important to note that most platforms set minimum deposit limits to filter out casual participants. Each exchange or lending service will have its own terms, so before selecting a cryptocurrency to lend, you should carefully review the project's conditions, read reviews, and check the platform’s rating.

Thankfully, researching a service today is easy. There are plenty of forums and websites where real users share their experiences and insights — so anyone who wants to dive deeper can do so with minimal effort.

Who may benefit from crypto lending?

Who would benefit most from crypto lending? This approach is ideal for long-term crypto investors who prefer to hold their assets, for those familiar with traditional fixed-income deposits, and for individuals who prefer not to stress over short-term market fluctuations. These are the lenders.

As for borrowers, crypto lending offers the opportunity to receive quick loans secured by collateral (such as Bitcoin), all without middlemen or extra fees from currency conversions. Borrowers can also repay the loan at any time without penalties, which adds flexibility.

For crypto project developers, lending is a useful tool for promoting and distributing new tokens in the market. It is an effective strategy for boosting adoption.

Crypto lending carries inherent risks, especially the threat of encountering fraudulent platforms disguised as legitimate services.

There is also the risk of lending tokens with poor backing, low liquidity, or unfavorable interest rates — all of which could lead to returns that fail to outpace inflation.

In short, crypto lending is best suited for experienced users of the crypto space rather than beginners.

Types of crypto lending

Crypto lending operates through decentralized protocols powered by smart contracts, where users lend out their assets to other users for a fixed period in exchange for interest.

While lending is fundamentally part of the DeFi ecosystem, it can also be carried out via centralized platforms. The core process remains the same, but the mechanics and risks vary significantly depending on the type of platform. Let us take a closer look at the main types of crypto lending available today.

Margin trading via crypto exchanges

Many major exchanges allow users to allocate their funds for lending. These funds are then provided to traders in the form of margin loans — borrowed crypto that can be used for leveraged trading. If the trader’s position is successful, they earn profit and repay the loan. The borrowed amount is returned to the original lender, and the platform collects a commission.

The size of the margin loan and the fee charged depend on the terms offered by the exchange. The trader’s initial capital acts as collateral, and the loan-to-value ratio can be multiplied by 3, 10, 20 — or even more.

If the trade is successful, the trader will be charged a commission ranging from 0.05% to 1% of the total amount used in the trade.

If the trade goes wrong, the platform issues a margin call to warn the trader of the losses. If the losses increase, the platform may automatically close the position to recover the loaned funds. In such cases, the trader may lose the entire margin deposit.

Exchanges typically charge a commission on every trade, regardless of whether it is profitable or not.

Peer-to-peer (P2P) lending platforms

A more traditional form of crypto lending is conducted through decentralized P2P protocols, where borrowers secure their loans with other crypto assets. In this setup, lenders and borrowers set the terms themselves, including the interest rate and the collateral amount.

Borrowers choose suitable offers and finalize the deal via smart contracts. Naturally, it is crucial to trust only those protocols that have passed rigorous security audits by reputable firms.

Investing in lending programs

Many centralized platforms offer investment-based crypto lending services. Acting as intermediaries, they issue loans using smart contracts or proprietary algorithms and promise investors a fixed interest return.

While this model offers simplicity and predictable income, it is also a magnet for fraudulent schemes. As the popularity of crypto grows, so do the risks. Before investing in any high-yield lending protocol, it is essential to thoroughly investigate the platform’s background, review the terms, examine its security infrastructure, learn about the team, and read user feedback on specialized forums.

Hybrid-type loans in crypto lending

Hybrid crypto loans work as follows: the user receives a loan in regular fiat currency, with the loan amount pegged to the current value of a crypto asset — most often BTC.

For example, a user borrows $100, which at the moment of issuance is equivalent to 0.0001 BTC. When it comes time to repay the loan, the borrower must return the dollar amount equal to the value of 0.0001 BTC at that time, regardless of how the Bitcoin price may have changed.

The same logic can apply in reverse: the loan may be issued in cryptocurrency but pegged to its fiat equivalent. This mechanism resembles strategies involving long and short positions in trading. For the investor who provides the funds, however, nothing changes. They lend a certain amount and earn interest on it, regardless of market fluctuations.

Which cryptocurrencies support lending?

Today, there are several tokens specifically designed to support crypto lending. These coins allow users to borrow money against their crypto holdings for personal use. Here are some of the most notable assets:

1. ETHLend is a token of a decentralized lending platform built on blockchain and smart contracts. Investors can earn up to 24% annually by lending out their crypto to other users for various purposes, from gifts to business funding.

2. Nexo is a token tied to a digital wallet of the same name. Nexo offers instant crypto-backed loans in over 45 fiat currencies. Interest is calculated daily and paid directly into the wallet. Deposits made through Nexo are also insured.

3. SALT is a lending platform that lets users earn from their crypto while receiving cash directly to a bank card. You can use your crypto as collateral and get the needed funds without selling your digital assets.

4. Ucoin Cash is a token that allows users to earn via lending, staking, and mining. Lending out Ucoin Cash can generate up to 45% monthly returns on investments, making it an aggressive but potentially rewarding option.

5. HomeBlockCoin is a cryptocurrency designed for lending. Users can transfer their coins to a trading bot, which performs trades on their behalf. Experts expect a positive trend in HomeBlockCoin’s value — but as always, only time will tell.

6. FalconCoin is a crypto asset with flexible lending durations and investment plans, allowing investors to manage their risk levels. The longest-term plans offer up to 45% monthly returns on invested capital.

7. BinaryCoin is a token developed by OPBinary. This token stands out for being backed by the company’s real products. Investors can choose from different investment programs with fixed terms of 30 or 90 days, each offering unique interest rates.

Crypto lending platforms

Lending platforms serve as a bridge between lenders, who invest their cryptocurrency in exchange for high returns, and borrowers, who take out loans in digital assets.

Centralized platforms play a controlling role in this process — they set interest rates, manage transactions, and provide a layer of security and reliability. In contrast, decentralized platforms are built on blockchain technology and smart contracts, enabling users from around the world to lend and borrow directly without the need to disclose personal information.

When choosing a lending platform, there are several key factors to consider:

· Supported currencies: Make sure the platform supports the specific cryptocurrency you plan to use. If not, you will need to find an alternative.

· Security: Especially on decentralized platforms, always be mindful of potential vulnerabilities in smart contracts, which could put your funds at risk.

Crypto exchanges that support lending

One of the easiest ways to earn from crypto lending is through cryptocurrency exchanges. Many exchanges offer lending options, but you should only trust those with official registration and a solid reputation in the market.

Some of the most well-known exchanges offering lending services include:

· Poloniex

· Coincheck

· Bitfinex

· YoBit

· Liqui

Users looking to work with these platforms should be prepared to undergo strict identity verification procedures (KYC).

BitConnect: cautionary tale in crypto lending

One infamous example of a crypto lending platform is BitConnect, a token launched in 2016. During its existence, the price of BitConnect soared from $0.14 to over $400, only to crash catastrophically to $19 on January 16, 2018.

The collapse came after an announcement on BitConnect’s official website declaring the closure of both its exchange and lending platforms.

The platform promised to repay all user funds into their BitConnect wallets at a rate of $363 per token, which reflected the average weekly price at the time.

So, what caused the sudden crash? Several factors likely contributed:

· A flood of negative user reviews across the internet, many highlighting serious security issues.

· Rumors and regulatory warnings about the platform’s potential shutdown by authorities in Texas and North Carolina spread rapidly.

· Frequent hacking attempts, which severely disrupted operations and occasionally completely disabled access to the platform.

These factors combined led to a rapid price collapse and a more than 20x drop in market capitalization, making BitConnect a textbook example of the risks involved in poorly regulated crypto lending.

Pros and cons of crypto lending

Advantages:

· The potential to earn passive and high-yield income for investors.

· A chance to profit from the appreciation of your cryptocurrency holdings.

· The ability to quickly obtain fiat loans without needing to sell digital assets or go through a traditional bank.

· Cryptocurrencies that support lending often attract more investor interest, which can lead to faster price growth.

· Lending is also beneficial for developers, as it helps them raise funds and promote their products more effectively.

Disadvantages:

· High risk associated with long-term investments.

· The need to lock up your capital for an extended period.

· The risk of fraud, especially with unreliable platforms or tokens.

Conclusion

Crypto lending offers a way to earn money by loaning your digital assets to other users or platforms. As we have seen, this method can be attractive both to investors seeking returns without selling their holdings and to crypto developers looking for funding and exposure.

Lending creates mutually beneficial relationships that can contribute to the rapid growth of a project’s capitalization. However, like any investment, crypto lending carries certain risks. That is why you should approach it carefully and do your due diligence before allocating your capital.

If you decide to buy crypto specifically for lending purposes, make sure you only invest what you can afford to lose so that any potential losses do not come at a heavy emotional or financial cost.

Also read:

Crypto processing

Fear & greed index for cryptocurrency

Crypto nodes

Crypto funding rates

Back to articles

Back to articles