Since digital currencies are still not recognized as a legal means of payment in many countries, using them in everyday life can be quite problematic. However, their price fluctuations and growth potential attract traders with the opportunity to profit from these movements.

There are various ways to earn from cryptocurrencies: you can simply invest money and wait for the currency to increase in value, or you can profit from daily fluctuations. One of the ways to generate income is scalping, which we will discuss in more detail in this article.

For more information on other ways to earn from digital currencies, how to avoid emotional trading, and how to maintain control of the situation, check out the article "Cryptocurrency basics."

Cryptocurrency trading strategies

Digital currencies are known for their volatility, meaning their value can change greatly within a short period—even within a single day. This characteristic attracts many users practicing intraday trading.

The main feature of intraday trading is that all positions are opened and closed within the same day, avoiding overnight holding. This allows traders to control costs and avoid paying additional fees for carrying positions into the next day.

Such trades can last anywhere from a few minutes to a few hours. Typically, the volume of each trade does not exceed 5% of the trader's total deposit. However, the most crucial aspect of intraday trading is the preparation beforehand—market analysis and identifying entry points.

Market analysis often relies heavily on technical analysis or a combination of technical and fundamental analysis. Technical analysis involves using price charts, trading volumes, and other tools to forecast future price movements.

This commonly suggests analyzing data from several weeks, months, or even years to identify patterns in price movements and predict future trends.

Fundamental analysis, on the other hand, provides a broader perspective by examining the factors that have a crucial impact on the market. It takes into account political, economic, and financial events, global shocks like wars or natural disasters, and many other factors.

Types of intraday trading

We’ve briefly outlined how cryptocurrency trading works and the preparation it requires. Here are the main types of intraday trading strategies:

- Range trading. This method is suitable when the price of a crypto asset does not experience significant fluctuations over a specific period but moves within a defined range or corridor.

- Arbitrage trading implies buying coins on one platform at a lower price and selling them at a higher price on another platform. Traders profit from the price difference of the same asset across different exchanges.

- Scalping means executing a large number of short-term trades, lasting from a few seconds to a few minutes. The profit from each trade is typically small, but the overall number of trades—potentially dozens per day—makes it profitable.

4. High-frequency trading (HFT) is a subtype of scalping but with even shorter trade durations—fractions of a second. Due to human limitations, this type of trading is only accessible to trading robots or specialized algorithms.

Challenges of intraday trading

All intraday trading strategies are considered quite risky and require significant time investment. Time is primarily needed for preparation, which includes analyzing the market and selecting entry points. However, even after opening a position, the trader must monitor the market closely.

This is crucial because market conditions can change suddenly, requiring the trader to act quickly. To mitigate risks and potential losses, it is essential to use Stop-Loss and Take-Profit orders, which automatically close trades when a pre-set price level is reached.

Another critical factor is the number of crypto assets a trader chooses to trade. Since cryptocurrencies are highly volatile, it’s advisable not to trade a large number of them. Instead, focusing on three to five currencies makes it easier to monitor their charts and take timely actions.

Crypto scalping: what you need to know

After we’ve covered some basic cryptocurrency trading strategies, let’s dive deeper into one of them: scalping. As mentioned earlier, scalping involves executing “quick” trades to profit from even the smallest price fluctuations of an asset.

The key to successful scalping is ensuring that the profit from each microtrade exceeds the trading fees charged by the exchange. By making a large number of small-volume trades, it’s possible to earn a significant amount in a single day.

Scalping-based strategies are considered among the most high-risk approaches. Traders must continuously monitor the market using various analytical tools to quickly identify unfavorable changes and close positions without losses.

This type of trading is also highly intense and can be both emotionally and physically exhausting. Such fast-paced trading increases stress levels, and not all traders can manage their emotions and handle the pressure effectively.

Another crucial element is the trader’s level of experience. Scalping requires specific skills and knowledge, which beginners often lack.

A clear trading plan is essential, outlining conditions for opening and closing trades, acceptable risk levels for each trade, capital allocation, and other parameters. Without a well-defined strategy, short-term trading is unlikely to succeed, as impulsive decisions can easily lead to mistakes.

On the other hand, traders who follow a personal set of trading rules tend to achieve more consistent results. Sticking to these rules helps them avoid making decisions driven by emotions or stress, minimizing the risk of unprofitable trades.

How to start scalping cryptocurrencies

Now that we understand what crypto scalping is, let’s discuss how to get started.

Step 1: choose a reliable exchange

This is a crucial decision. Compare conditions, fees, available tools, and reviews from real users before selecting a platform.

Step 2: develop a trading strategy

Your strategy should include clear rules covering:

- Methods for market analysis

- Identifying entry points for trades

- Position holding

- Trade exits

- Risk management

- Capital management

For beginners, creating such a strategy might seem overwhelming. Initially, you can use existing strategies available online and gradually transition to developing your own rules as you gain experience and knowledge.

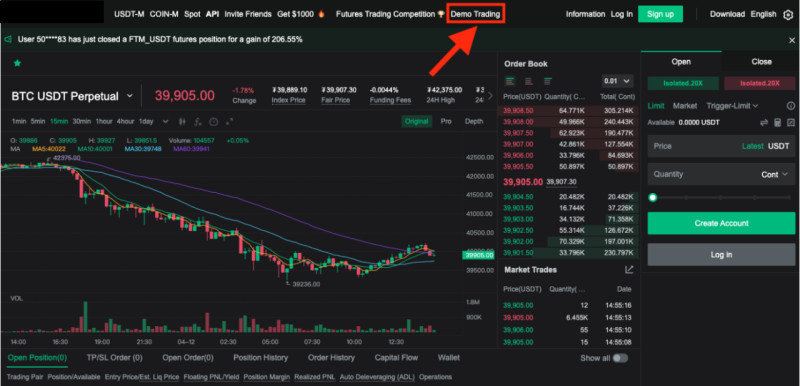

Regardless of whether you use a ready-made strategy or create your own, always test it on a demo account first. A demo account allows you to trade using virtual money, so you can experiment without risking real capital.

Even experienced traders use demo accounts to test new strategies. Once you achieve consistent profits on a demo account, you can move on to real trading.

Since scalping can be exhausting, it’s recommended to take breaks and allow yourself time to rest. Without proper rest, it’s difficult to avoid decision-making errors, which can lead to losses.

Tools for scalping

Preparation—primarily market analysis—is one of the most critical aspects of scalping. The success of your trades depends heavily on how well you analyze the market. As mentioned earlier, technical analysis plays a central role.

Here are some of the most commonly used tools in scalping:

- Moving Averages (MA)

These trend indicators help identify the direction of an asset’s price movement. They follow the price chart, and when multiple moving averages are applied, their intersections can signal trade opportunities.

2. Support and resistance levels

These lines are drawn based on price highs and lows and define the range in which the price moves over a specific period.

3. Relative Strength Index (RSI)

This oscillator measures momentum, indicating whether buyers or sellers dominate within a given timeframe.

While individual indicators can be useful, relying solely on one is not recommended. Some indicators lag behind price movements, while others may lead them. Using a combination of indicators is the best approach, as they can confirm or adjust each other’s signals.

Additionally, non-indicator methods like chart analysis and candlestick analysis can be very helpful. Chart analysis involves studying price movements and identifying patterns, while candlestick analysis focuses on finding specific Japanese candlestick formations that may indicate potential changes in the market.

How to trade cryptocurrencies: strategies for scalping

Now that we’ve discussed the tools for market analysis, let’s explore specific strategies traders can use when employing crypto scalping.

- Bounce trading

When an asset’s price moves within a channel defined by support (lower border) and resistance (upper border) levels, traders can open two types of positions:

- Short positions (selling) at the point of a bounce from the resistance level, anticipating a price decrease.

- Long positions (buying) at the point of a bounce from the support level, anticipating a price increase.

2. Breakout trading

Prices cannot move within a channel indefinitely. Eventually, a breakout occurs, leading to a significant price rise or fall. In this case, a trader must correctly identify the breakout moment to enter a position promptly.

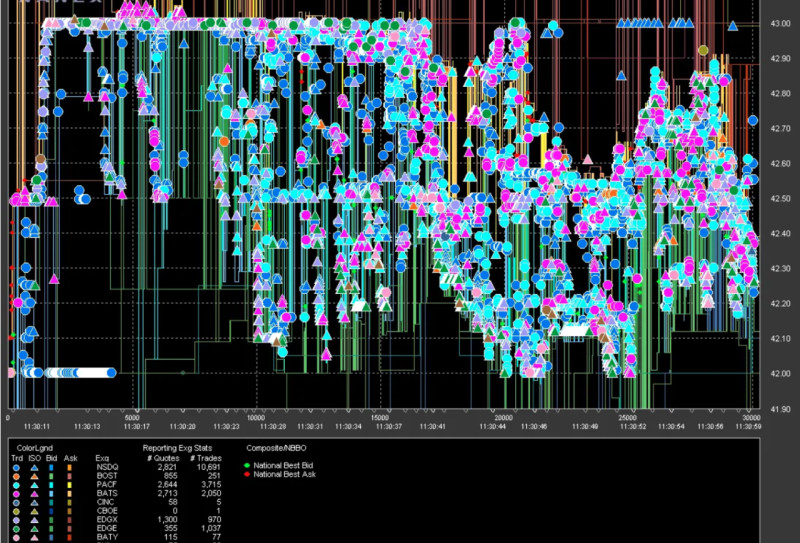

3. Order book trading

The order book is a tool used for market analysis that displays limit orders placed by traders. This allows users to determine the current price of a crypto asset and predict its future changes.

4. Catching the “Knives”

This strategy involves trading based on specific candlestick patterns that show a strong imbalance between supply and demand. These patterns can help scalpers forecast prolonged price increases or decreases, enabling them to open multiple sequential trades in the same direction.

Regardless of the chosen strategy, it is critical to adhere to risk and money management rules, including setting a limit on the percentage of the deposit to risk in a single trade. Let’s dive deeper into risk management in the next section.

Risk management

Trading without losses is impossible, but crypto scalping is particularly risky due to the speed and frequency of trades. Therefore, it is essential to include risk management rules in your trading strategy.

The foundation of risk management is controlling allowable losses, also known as a “drawdown limit.” This is the maximum amount a trader is willing to lose in a single trading session or day. Traders should set this limit based on their financial capacity and never exceed it, regardless of whether it’s reached at the start, middle, or end of the trading day. Once the drawdown approaches this level, all open positions should be closed, and trading should be paused for the day.

Other key risk management principles include:

- Position size limits. In scalping, individual trades should involve only a small percentage of the total deposit, typically 1–2%. This minimizes potential losses in case of unsuccessful trades.

- Protective orders. Setting Stop-Loss and Take-Profit orders is crucial. These orders automatically close a trade when the price reaches a specified level, protecting traders from emotional decision-making. For instance, if an asset’s price starts to fall, traders might hesitate to close a position, hoping for a rebound, only to incur greater losses as the decline continues.

Since scalpers often have multiple positions open across different assets, tracking all charts in parallel can be challenging. Protective orders ensure trades are closed automatically when conditions turn unfavorable.

Automating scalping with trading bots

The high intensity of scalping can make it an exhausting activity, especially when trading multiple currencies simultaneously. Specialized programs—trading bots—have been developed to simplify the process.

Key features of trading bots include:

- 24/7 trading. Bots don’t require rest, sleep, or food, allowing continuous trading—a significant advantage for high-frequency strategies like scalping.

- Fast data processing. Bots can process vast amounts of data within seconds, far faster than humans, enabling quicker decision-making.

- Customizable settings. Bots can be tailored to individual traders' needs, allowing the integration of specific indicators and parameters for analysis.

- Free demo versions. While full versions of trading bots can be expensive, many offer free trial versions to test their functionality.

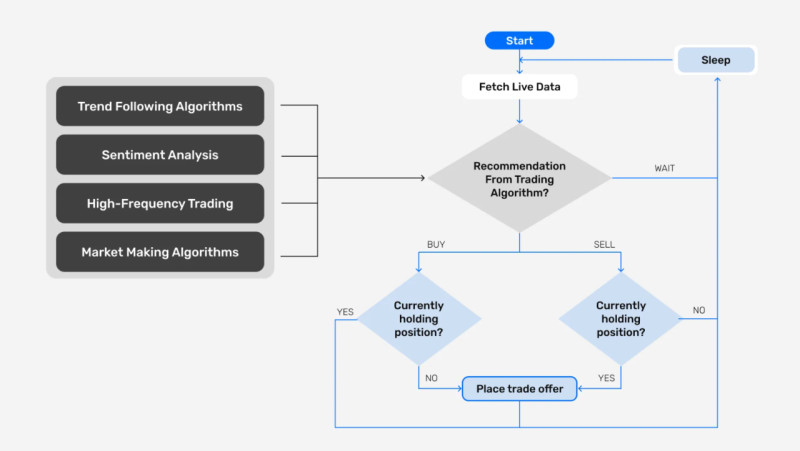

Bots can analyze the market and even execute trades. They are divided into two main types:

- Fully automated bots analyze the market and execute trades autonomously based on predefined algorithms.

- Semi-automated bots (advisors) analyze the market and identify optimal entry points but leave the final decision to the trader.

While trading bots offer convenience, experts and experienced traders recommend against relying on them entirely. Markets are prone to sudden events that can cause sharp price fluctuations. In such situations, bots may continue to trade based on their algorithms without accounting for unexpected developments.

By combining automated tools with manual oversight and a well-structured trading strategy, scalpers can maximize their effectiveness while minimizing risks.

Advantages and disadvantages of crypto scalping

Like any trading strategy, crypto scalping has its pros and cons. Let’s explore them in detail.

Advantages

- Quick profits. Since traders execute numerous trades in a single trading day, they can immediately see the results of their efforts. This provides motivation to improve or move forward, even if the results are less than satisfactory.

- Gains from small price fluctuations. Scalpers make use of even the smallest price changes, creating more opportunities for profit compared to traders who rely on longer-term strategies and must wait for the ideal moment.

- Low initial capital. Scalping does not require large initial investments. The focus is on executing quick trades with small volumes.

- Use of trading bots. Given the high intensity of scalping, trading bots significantly ease the process by quickly analyzing market conditions and making trading decisions.

- Low risk per trade. Due to the small position sizes, potential losses are minimal. Even with poor risk management, it is challenging to incur substantial losses.

Disadvantages

- High intensity. Scalping is mentally and physically exhausting due to its fast-paced nature. Fatigue can lead to mistakes, which is why traders must strictly follow their strategy and avoid emotional decisions.

- High fees. Each trade, regardless of size or profitability, incurs a fee. Scalpers must monitor these fees to ensure they do not exceed potential profits.

- Low profit per trade. Since profits per trade are small, scalpers must execute many trades to achieve a satisfactory daily income, while traders using other strategies may earn the same amount with fewer trades.

- Time-consuming. Scalpers must constantly monitor the market to react quickly to sudden changes. This demands significant time, often turning trading into a full-time occupation.

Alternatives to scalping

If short-term trading does not suit a trader’s temperament, they can consider other approaches such as medium-term or long-term trading.

Below is a comparison of short-term, medium-term, and long-term trading:

| Parameter | Short-term trading | Medium-term trading | Long-term trading |

| 1.Position holding | Within one day: seconds to hours | Several days to weeks | Several months to years |

| 2.Number of trades | Dozens or hundreds per day | A few trades per week | One or a few trades per month |

| 3.Market monitoring | Constantly throughout the day | Once per day | Once every few days or weeks |

| 4. Analysis | Primarily technical | Combination of technical and fundamental | Primarily fundamental |

Medium-term trading

Medium-term positions can remain open for several days to weeks, making it suitable for times when the market exhibits a stable trend. Traders often wait for favorable opportunities to open a position, and profits per trade can reach several dozen points.

A major advantage of medium-term trading is the reduced need for constant monitoring. Checking market conditions once a day is usually sufficient. Unlike scalping, minor price fluctuations are irrelevant to medium-term traders, although high cryptocurrency volatility can increase both profit potential and risk.

Long-term trading

Long-term trading, also known as position trading, involves holding positions for several months or even years. Traders using this strategy are not concerned with daily price fluctuations but instead, focus on the potential for significant growth over time.

Such growth may be driven by factors like the legalization of a cryptocurrency as a payment method or the innovative nature of the project behind a particular token.

The key to successful long-term trading is selecting the right crypto assets. Investors often choose emerging projects with potential or established cryptocurrencies with growth opportunities. Diversification is essential—funds should be spread across multiple assets rather than concentrated in one.

Conclusion

One of the defining characteristics of cryptocurrencies is their high volatility. Prices can experience significant swings within a single day, let alone over longer periods. Scalping takes advantage of these fluctuations to generate profits.

The essence of scalping lies in executing a large number of quick trades, each lasting from a few seconds to a few minutes. While profits from individual trades are small, the cumulative effect of dozens or hundreds of trades per day can result in substantial earnings.

A crucial aspect of successful scalping is preparation, including thorough market analysis. Additionally, every trader must have a well-defined trading strategy that incorporates rules for executing trades, risk management, and more.

The downside of scalping is its high intensity, which can lead to fatigue and errors. However, trading bots can help alleviate some of the burden by automating market analysis and, if necessary, executing trades.

Scalping, while demanding, is a viable strategy for traders willing to commit to its fast-paced nature and develop the necessary skills to thrive in such an environment.

Back to articles

Back to articles