Cryptocurrencies today are perhaps one of the most popular forms of virtual assets and a trend in the financial world that everyone should be aware of, or at least strive to understand. It’s tempting to insert a standard definition of “cryptocurrency” here, but that might be redundant as the term is so common in modern society that hardly anyone would hear it and not know what it means.

Cryptocurrencies today are perhaps one of the most popular forms of virtual assets and a trend in the financial world that everyone should be aware of, or at least strive to understand.

It’s tempting to insert a standard definition of “cryptocurrency” here, but that might be redundant, as the term is so common in modern society that hardly anyone would hear it and not know what it means.

In a nutshell, cryptocurrencies are an alternative to traditional money, existing entirely in digital form. These assets use cryptographic methods to secure transactions and manage the issuance of new units.

They are generally independent of centralized authorities like governments or financial watchdogs. Most cryptocurrencies operate in a decentralized system without any managing institution.

Each cryptocurrency is unique, possessing its own specific characteristics and functions. Anyone aiming to become an active participant in the cryptocurrency market must study the basics of cryptocurrencies, the different types of these assets, their functionality, and various mechanisms including rewards, earning methods, potential risks, and other important aspects of this industry. This is precisely what we will discuss in this article.

Types of crypto assets

Cryptocurrencies are a special type of electronic money that are not stored in centralized systems (as we are used to with regular fiat money), but function on a blockchain.

You are probably aware that blockchain is a technology that represents a virtual database containing records of all transactions and user accounts. Blockchain allows for the transfer of assets between users and serves as reliable proof of ownership of these assets.

Special wallets are used to store and transfer virtual money, providing access to blockchain accounts through a pair of keys: a public key and a private key. These keys are essential for creating and signing transactions.

Cryptocurrencies today are a trend that offers a unique opportunity to exchange money with literally no restrictions. This is precisely why they are so popular.

Most cryptocurrencies bear an open-source code, allowing developers to generate new types of virtual assets based on them. Cryptocurrencies are divided into the following groups:

| Bitcoin | Bitcoin is the very first and most valuable cryptocurrency, with the largest market capitalization. We will discuss the concept of capitalization later. Bitcoin is often considered a separate type because its state can influence the entire crypto market. Many call Bitcoin the "grandfather." And there is some fairness in this: where the grandfather goes, all other cryptocurrencies follow. It determines the direction and trends of the industry. |

| Altcoins | This is a general term for all cryptocurrencies that are not Bitcoin. The name speaks for itself: altcoin means "alternative coins." This is a very broad group of virtual money. Altcoins include thousands of different cryptocurrencies. |

| Stablecoins | These are a special type of cryptocurrency with a fixed value. The price of a stablecoin is tied to traditional currencies, most often the US dollar. This feature ensures stability and makes them useful for preserving value. |

Altcoins, in turn, are divided into two main categories:

- Coins are cryptocurrencies that have their own blockchains. They can be called fundamental assets in the crypto world. There are far fewer coins than tokens.

- Tokens are cryptocurrencies that use the blockchain of other cryptocurrencies. They have their own value but cannot be considered full-fledged payment means. Tokens are used within specific projects or applications.

Summary

To summarize, there is the important and most valuable asset, Bitcoin. Apart from it, there are all other cryptocurrencies, altcoins. Altcoins are further divided into coins and tokens. Stablecoins stand apart from them all.

To better understand who is who in the crypto world, let's use a familiar example from real life. A coin can be compared to our local currency, which is a full-fledged payment means. Tokens, on the other hand, can be likened to subway tokens, which are limited in use – you can only use them as payment within the subway system and nowhere else. Coins can be used widely, while tokens are limited to specific projects.

If you plan to buy or sell cryptocurrencies, you must know the basics of cryptocurrencies and understand all their types. It is also important to remember that it does not matter which cryptocurrency you decide to buy (coin or token) because there is no difference in the potential for price growth.

For example, your wallet may hold 20 different cryptocurrencies, of which only 4 may be coins, and the rest may be tokens. You will have more tokens not because they are more profitable to hold, but simply because there are ten times more of them in the crypto market.

What is staking

Even if you are new to the blockchain world, you have probably heard of cryptocurrency staking. This term refers to a popular function in crypto communities that allows virtual money holders to earn passive income.

Cryptocurrency staking is a reward mechanism where holders of cryptocurrencies receive a steady income from their assets.

Staking allows token holders to deposit them in a smart contract for staking. As a result, these tokens become temporarily unavailable for urgent trading or quick transfer, but they still belong to the network participant and generate rewards.

Staking typically involves a certain profit, denominated in percentages. The staking reward is distributed among users based on their share, i.e., the amount of coins or tokens they control and deposit into the staking smart contract.

Let's illustrate this with a simple example. Anna and Dan own VRA tokens, and 100 such tokens are locked in a staking smart contract. Alice contributed 10 tokens, while Bob only contributed one. Staking offers a 0.7% return, distributed proportionally to each participant's share. Thus, Alice's income will be ten times higher than Bob's, even though the percentage rate was the same.

Staking rewards usually pile up, increasing the participant's share and, consequently, their income. This is similar to how compound interest works in traditional financial markets. It encourages long-term investment in the staking ecosystem.

Importantly, staking matters not only to earning potential. By participating in staking, users contribute to the stability and security of the blockchain network. Systems that use the proof-of-stake (PoS) mechanism include staking in their consensus algorithm, enabling transaction processing and new block creation without high energy consumption. In contrast, proof-of-work (PoW) systems, based on mining, require significant electricity costs.

PoS protocols can be called more environmentally friendly, allowing users to earn on their investments without requiring significant investments in mining equipment. This can be considered a healthier alternative to traditional mining methods.

What is scalping

In the crypto industry, there are several types of trading:

- Intraday trading

- Medium-term trading

- Long-term trading

- Algorithmic trading

This is by no means an exhaustive list, but we'll focus on these four types. Intraday trading (which is one of the most common) is essentially cryptocurrency scalping.

This type of trading attracts many novice crypto traders who don't know the basics of cryptocurrencies, lack trading experience, and have little knowledge of trading strategies. Beginners often get carried away, neglect analysis and thorough planning, lose their entire deposit, and usually abandon trading altogether. This is the wrong approach.

Yes, this type of trading is fraught with the risk of losing your deposit, often due to the lack of experience and knowledge of the trader.

What should a rookie trader know about scalping? Firstly, scalpers use short timeframes in their trading and profit from small but frequent price movements throughout the day or week.

Secondly, scalpers rarely keep positions open for long – sometimes less than a minute. Scalping requires the trader to react instantly and be especially attentive to identify immediate trading opportunities. Significant price fluctuations can occur within just a few seconds. Scalpers profit from these fluctuations, making it extremely important to catch them.

Scalping is undoubtedly for stress-resistant individuals, as this trading style does not tolerate haste and disorganization. To be frank, if you can't handle stressful situations, scalping is not for you.

Scalpers often trade manually, avoiding automated trading systems, and close all positions by the end of the trading day. Closing positions by the end of the day is important to avoid losses often arising from price gaps.

Scalpers not only study charts but also actively use the order book. In scalper slang, the order book refers to the queue of exchange orders. It is also called the tape of clustered trades. Monitoring the order book is crucial to timely decide when and at what price to enter or exit the market.

A scalper's workday typically lasts 6 to 8 hours. Scalpers equip their workspace with multiple monitors to simultaneously track numerous information streams.

Scalping requires not only market analysis skills but also psychological stability. Without exaggeration, this type of trading can be called one of the most risky, as it requires constant concentration and attention. For this reason, scalpers would benefit from taking occasional breaks from trading to avoid fatigue and maintain mental clarity and quick reactions.

Scalping is serious daily work that requires a lot of time, effort, and discipline. Therefore, before deciding to invest significant amounts, novice traders should practice with small deposits to better understand the nuances and risks of this trading style.

Capitalization of crypto assets

The basics of cryptocurrencies also include the concept of capitalization. The price of one company's share does not determine the overall value of the corporation. For example, Company X's shares might cost less than $5 each, but the company's total value could significantly exceed that of Company Y, whose shares are priced at $600 each.

The market value of a company is assessed using the capitalization indicator, which we will discuss in this section. A company's capitalization is calculated as follows: the current share price is multiplied by the total number of shares outstanding.

If a company has different types of shares, the capitalization is calculated for each type first, and then the results are added up. If shares are traded on multiple exchanges, the capitalization can be calculated based on the share price on one of the exchanges.

Cryptocurrency capitalization is a measure of their market value, just like with companies.

At the beginning of 2020, the total capitalization of cryptocurrencies exceeded $300 billion. By January 2021, this figure had increased to nearly $1 trillion, driven by an unprecedented surge in cryptocurrency popularity and Bitcoin's rise to a new all-time high.

To determine the capitalization of a cryptocurrency, the same calculation is made for a company's capitalization: the total number of coins in circulation is multiplied by the current price of one coin.

However, it is important to understand that capitalization in the crypto world may not always be an objective barometer. The fact is that cryptocurrencies do not have an intrinsic value similar to company shares.

Different laws govern the cryptocurrency sphere. For example, many companies hold a portion of tokens for internal use and release only a small part for sale. Due to the limited availability of tokens for a single buyer and the release of a small portion of tokens on the crypto exchange, the assessment of crypto assets' capitalization cannot be called objective.

The crypto market is structured so that a significant portion of its assets are not put up for sale on exchanges but are held by investors as long-term investments.

What is listing and how to profit from it

When we say a trader should know the basics of cryptocurrencies, we also mean cryptocurrency listing. Before cryptocurrencies and tokens become available to users in the market, they must undergo comprehensive analysis. Only after several stages of selection can they be listed for sale on crypto exchanges.

The process of adding cryptocurrencies to an exchange is called listing. This procedure influences the future development and popularity of the assets.

Cryptocurrency listing is the process by which new digital coins are included in the list of tradable assets on a cryptocurrency platform. After the listing is implemented, they finally become available for purchase or sale.

The crypto market is continuously growing, with thousands of new coins designed each year. Due to high competition, developers strive to promote their coins more effectively, and listing on an exchange is the driving force behind their recognition.

The success and demand for a cryptocurrency are often linked to the number of platforms where it is listed. The more exchanges that include it in their list of tradable assets, the more successful and valuable the cryptocurrency becomes.

The listing process is usually initiated by the creators of the coin, although sometimes exchanges can add a popular asset to their platform on their own.

Listing methods can vary depending on the exchange. Each crypto platform has its criteria and specific conditions for selecting assets. Some exchanges set higher requirements for new coins, while others may be more lenient.

To get listed on an exchange, developers need to go through several stages:

- Fill out a form with basic information about the project, including the creation date, Github page, white paper, and details about mining potential and emission volume.

- After receiving the necessary information, the exchange platform will start analyzing the profitability and liquidity of the new asset. A special commission will then decide whether to add the coin to the list.

- If the new asset satisfies the commission and a positive decision is made, the asset creator and the exchange platform sign an agreement.

Exchanges pay close attention to many factors – the functionality of the coin, its utility and value, the level of security, and the reputation of the developers.

Sometimes exchanges even conduct polls among their users to determine which coins would be good to add to the listing. Naturally, the winners of such polls are eventually added to the list.

Listing, by the way, is often a paid service, but there are exceptions. For example, the Poloniex exchange claims that adding coins to its platform is completely free, while the Binance exchange prefers to charge a fee for adding an asset to its platform (claiming that the fee is used exclusively for charitable purposes).

Experienced investors often profit from listings – they track news about upcoming additions and buy assets before they appear on the exchange, then sell after the price rises. The key here is to correctly determine the exit point, as the asset's value usually starts to decline after a short period of high demand.

Beginners should sell coins immediately after the price rises, not waiting for further price increases. However, if you are an experienced trader, you can try to maximize profits by tracking price corrections and exiting the market at the peak.

Processing in crypto industry and how to profit from it

Knowing and understanding the basics of cryptocurrencies also means understanding processing. Cryptocurrency processing represents a type of arbitrage that has not yet gained widespread popularity among users. Let's be honest, few people understand what it is. Yet, it is an interesting and profitable topic.

In the financial sphere, processing traditionally means payment processing. In the context of cryptocurrencies, it is related to processing payments in cryptocurrency. While it seems simple, there are enough nuances in this topic.

For example, consider online stores that buy goods abroad and sell them on the domestic market, receiving payments on bank cards and transferring money back for future purchases. They need to efficiently convert currencies while minimizing fiscal risks.

Arbitrageurs help in such cases by providing cryptocurrency processing services – they accept money and issue USDT, ensuring quick returns in cryptocurrency.

Store owners understand they lose 1-3% on such services, but they solve many problems and, importantly, save time. Frankly, losing 1-3% is quite normal for such a business.

For arbitrageurs, this earning scheme looks as follows:

- Receiving money on bank cards.

- Exchanging money for USDT at a lower price (e.g., through Binance).

- Selling USDT to the client at a higher rate.

- Earning on the exchange rate difference.

While this process seems simple, it requires significant organization, multiple bank cards, and the unique ability to adapt to the client.

Besides stores, cryptocurrency processing services are in high demand among crypto exchanges and companies dealing with cryptocurrency rearrangements, casinos, betting platforms, and various services that prefer not to use their own cards for transactions. In short, processing services are in demand across many business areas.

In the world of cryptocurrency arbitrage, there are very few companies that provide such services, meaning there is little competition in this area. Less competition means more significant opportunities for those who want and can offer reliable and quality services in this direction.

Understanding fear&greed index

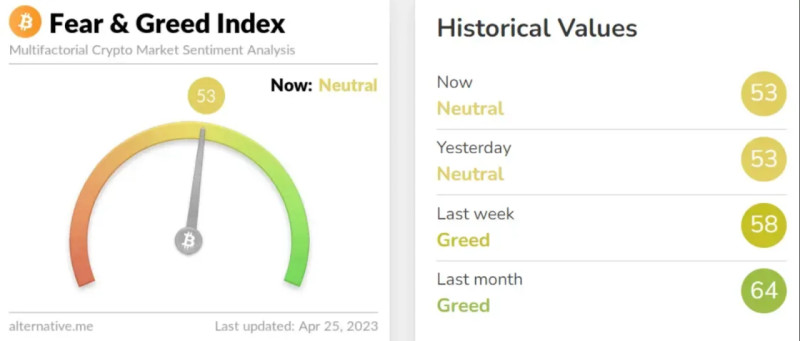

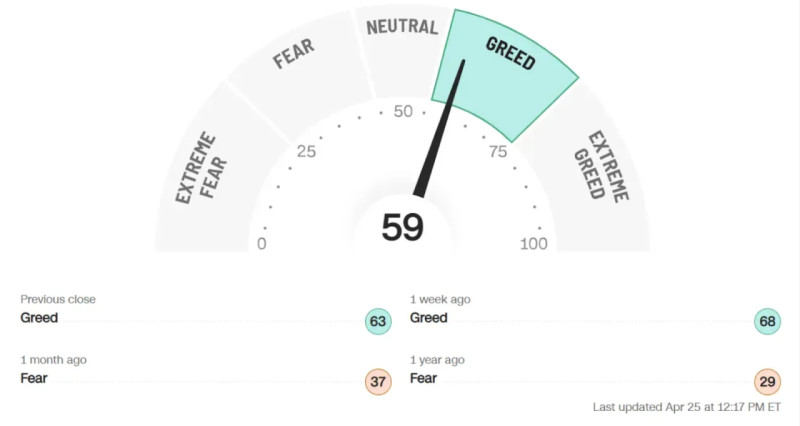

The basics of cryptocurrencies must include the concept of fear and greed, more specifically, the index that measures their levels.

In all financial markets, and particularly in cryptocurrencies, most decisions are based on emotions. It's human nature – when seeing a sharp increase in asset prices, people experience FOMO (fear of missing out), which pushes them to open impulsive long positions.

During periods of sharp price fluctuations of an asset, people often feel the urge to increase their investments to gain more profit, driven by greed.

When the market is dominated by absolute fear, it may indicate that cryptocurrencies are undervalued. This often leads to massive sell-offs and panic among market participants. However, it’s important to understand that such fear doesn’t always signify a long-term downward trend and can be temporary.

The cryptocurrency fear and greed index helps analyze these emotional market states and determine how inclined market participants are towards greed or fear. The index is measured on a scale from 0 to 100, where 0 indicates extreme fear and 100 indicates extreme greed. An average score of 50 shows that the market is in a state of equilibrium.

The scale of the index can be roughly divided into several stages:

| 0–24 orange | 25–49 yellow | 50–74 light green | 75–100 green |

| extreme fear | fear | greed | extreme greed |

The fear and greed index is measured based on the following data:

- Volatility (25% of the index): Current volatility and the maximum price drop of BTC are compared with their average values over the last 30 and 90 days to determine the degree of market instability.

- Market volume and momentum (25%): Current trading volumes and market momentum are analyzed to assess the level of market activity.

- Social media (15%): Activity and spread of hashtags related to cryptocurrencies (e.g., on Twitter) are studied to evaluate public interest.

- Surveys (15%): Weekly surveys among market participants on various platforms are conducted to understand the overall sentiment among investors.

- Bitcoin dominance (10%): The share of Bitcoin in the total market capitalization is analyzed. For example, an increase in Bitcoin dominance arises from fear of highly speculative investments in altcoins, making Bitcoin a safer capital preservation tool. Conversely, if Bitcoin dominance falls, it means people are overly greedy and willing to invest in riskier assets.

- Google Trends (10%): Interest in Bitcoin and other cryptocurrencies is tracked through the analysis of Google search queries to monitor changes in popularity and attention to digital assets as a whole.

As we can see, the fear and greed index combines data from various sources, helping to better understand the emotional state of the market and make more informed decisions.

Lending or collateralized loans

To better explain what crypto lending is, let's use a simple example.

Suppose you already have an apartment, but you want to buy a second one, and you don’t have enough money. The traditional approach of saving for years doesn’t suit you, as it takes too long. Using the apartment as collateral to get a loan is also not ideal because banks often give a smaller amount than expected and charge high interest rates.

It’s a dead-end situation: you have an apartment but can’t progress further because the income from this apartment won’t allow you to buy a second one in the near future.

Now, let's imagine a similar situation in the world of cryptocurrencies. Lending platforms allow their clients to take loans using their cryptocurrencies as collateral. This is akin to getting a mortgage using your apartment as collateral. Additionally, you can still rent out the collateralized cryptocurrency, thus earning extra income from staking.

In this context, you can buy cryptocurrency, use it as collateral, and get a loan in stablecoins like USDT, USDC, DAI, or other cryptocurrencies like WBTC or ETH. Interest rates usually range from 1% to 5%, but sometimes they can go up to 10%. You can also get a loan for about 70% of the value of your collateral.

If the value of your collateral starts to fall, the lending service will automatically sell your asset on the market to cover the loan. The service will also charge a penalty – about 5-7% of the repayment value.

To use such a service, you need to transfer cryptocurrency from a centralized exchange to the blockchain where the lending service operates, and then to your wallet (e.g., MetaMask or Trust Wallet). After that, you can exchange your cryptocurrency for another on decentralized exchanges using aggregators.

To start lending on a platform like AAVE, you need to connect your wallet to the platform, permit it to use your cryptocurrency, and then add it to the platform to get a loan.

This approach allows you to use cryptocurrency to obtain financing under similar conditions. It's like using real estate, but with the added bonus of earning from staking at the same time.

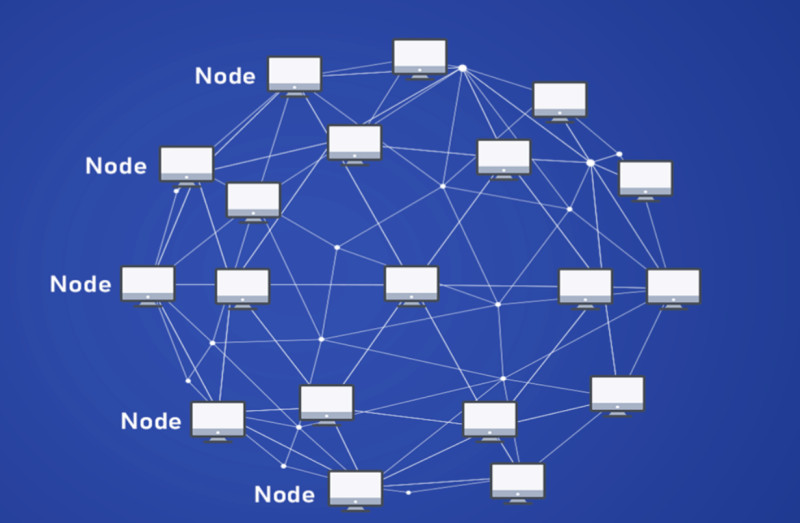

What are nodes?

The basics of cryptocurrencies include concepts such as nodes, which are inseparable from the concept of mining. We remind you that mining is the process of purchasing special equipment to connect to the blockchain network and mine cryptocurrency.

Mining is based on the Proof-of-Work (PoW) consensus principle. Later, due to its drawbacks, such as environmental impact, limited scalability, and centralization, an alternative was developed – blockchain networks based on the Proof-of-Stake (PoS) consensus.

The essence of PoS is that instead of buying expensive equipment, network participants can rent a virtual server to participate in the blockchain. This maximizes decentralization, environmental friendliness, and scalability of the network, thus addressing previous issues.

In the PoS system, there are validators and delegators. Validators are users who run a node (the very nodes of cryptocurrencies) and become part of the blockchain, similar to miners in the PoW system.

Delegators invest their coins in validators to receive an annual income percentage. Thus, validators increase their stake pool and can process more blocks in the blockchain. Validators usually take a commission from the delegators' income. Becoming a validator is not easy as it requires significant investment and experience.

However, it is not necessary to be a validator to participate in the process. Before launching the mainnet, each project tests its network (testnet). These can include:

- Stress tests on the network load (here you need to run as many nodes as possible and see if the network can handle it)

- Transaction tests (within one network)

- Validator and delegator tests (test tokens are provided to run your node, no investments are needed)

Other testnet variants also exist and vary from project to project.

In these testnets, you will need to run nodes, and after completion, receive a reward, such as project tokens. The final profit can only be calculated once the token is listed on an exchange and its real price is known. This is the essence of uncharted nodes.

Profit is measured after the token is listed on an exchange when its real price becomes known.

Earning from nodes is quite realistic and possible, but it is not quick money. Some testnets can last from several days to a whole year, each project being unique. But thanks to the vast variety of projects in the market today, you can participate in many and eventually receive your rewards.

What is volatility?

Cryptocurrency volatility is the degree of price fluctuation for a specific asset.

The crypto market operates around the clock without breaks, and quotes move at insane speeds. Exact prices for digital assets the next day are impossible to predict, and within 24 hours, the price can significantly rise or fall, sometimes by more than 90%.

Moreover, it's important always to remember the influence of "whales" – investors with large reserves of assets, who can significantly affect the market with their large-scale buying or sell-offs.

When determining your trading strategies, it's important to consider the expected volatility or price change forecasts for a specific cryptocurrency.

To determine how volatile an asset will be, consider these parameters:

- Current coin price

- Historical volatility indicator

- Overall market sentiment

- Coin liquidity

- Capitalization and changes in project popularity

- News that may affect the coin's rate

The volatility indicator determines the asset's value: for some traders, sharp price jumps may be quite attractive for investment, while others may prefer more stable assets.

Traders focused on long-term investments usually avoid highly volatile assets due to the uncertainty in long-term prospects.

Why are cryptocurrencies so volatile? The main reason is the unpredictability of their future, with constant media reports about the potential collapse of the crypto system or, conversely, prospects for radically changing the entire financial system towards the crypto world.

Even small initial jumps can cause significant price drops because traders might panic and rush to sell their assets. At the same time, positive news or even just rumors may cause rapid rallies.

What funding means

If a trader holds an open position in perpetual futures, they must consider a significant expense – funding rates, also known as cryptocurrency funding.

Everyone learning the basics of cryptocurrencies should grasp the point about perpetual futures contracts. These futures are widely used on many leading cryptocurrency exchanges. Perpetual futures monitor the price quotes of cryptocurrencies and associated digital assets. Unlike traditional futures contracts, which have a specific expiration date, perpetual futures can be held for any period. This makes them a popular tool for cryptocurrency trading with significant leverage.

For example, if a trader wants to open a long position of $100,000 in Bitcoin but only has $1,000 in their trading account, they can use 100x leverage. This can lead to substantial profits if the price of Bitcoin rises. However, a price drop of just 1% can completely wipe out their trading balance upon position liquidation.

The funding rate, or cryptocurrency funding, consists of periodic payments traders receive for holding positions in perpetual futures. This rate is adjusted by the exchange several times a day to ensure the futures price does not deviate too far from the price of the underlying asset. The funding system on exchanges works in such a way that funds are automatically deducted from some traders and almost immediately credited to others.

If the price of a perpetual future exceeds the price of the underlying asset, the funding is considered positive. In this case, traders with long positions pay the funding rate, and traders with short positions receive it.

Conversely, if the future price is lower, the funding is considered negative. In this scenario, the funding rate is charged to traders with short positions and paid to traders with long positions.

Funding rate changes occur every few hours, depending on the exchange’s policy and the state of the cryptocurrency market. For instance, Binance updates its rates every 8 hours.

When the market is in a bullish trend and prices are rising, the number of traders with long positions starts to exceed those with short positions. Consequently, those with long positions will pay positive funding to those with short positions at that time.

During a bearish trend, when prices are falling, the situation is the opposite: traders with long positions receive funding from those holding short positions.

As we can see, funding rates are very useful – they motivate large traders and market makers to participate in the market, actively open long or short positions, and thus keep futures prices aligned with current market prices.

Funding is an important mechanism that ensures balance and stability in the perpetual futures market, preventing excessive price deviations from the real values of the underlying assets.

When the market is actively growing, traders with long positions essentially compensate for the risk of those willing to take the opposite side of the trade. This provides additional motivation for market participants to interact more actively with each other, helping to create greater liquidity and reduce market risk.

Funding rates not only regulate economic relationships between traders on the exchange but also reflect the overall economic atmosphere in the crypto industry. Changes in these rates can signal to traders that there are imbalances in supply and demand. Thus, funding helps make more informed decisions about entering or exiting the market.

It's important to understand that managing positions with funding requires traders to be vigilant and understand current market conditions to avoid unwanted losses and optimize potential profits. Successfully using this tool can help improve the efficiency of a trading strategy, especially in the high volatility of the cryptocurrency market.

Back to articles

Back to articles