What is a cryptocurrency?

Cryptocurrency is a decentralized asset that exists only in a digital form and cannot be controlled. It operates in a system known as blockchain, a chain consisting of blocks with specific information.

Unlike centralized servers located in one place, blockchain data is distributed across computers worldwide. A single unit of such currency is called a coin or token, depending on the type of digital currency.

Cryptocurrency's lack of centralization comes with both pros and cons. One disadvantage is the irreversibility of transactions. Once a transaction is completed, it cannot be canceled or disputed, unlike in banking systems, where such operations might be possible. Additionally, if a bank suspects fraudulent activity, it can freeze funds, which is less likely in cryptocurrency.

One of the advantages of digital assets is their efficient peer-to-peer functionality. This allows users to conduct transactions without intermediaries and the fees that come with them. Another benefit of cryptocurrency is the security it offers for storage and transactions. All transaction data is known only to those involved, and it is impossible to withdraw the currency without the owner's physical access.

A key difference between cryptocurrency and other assets is that many cryptocurrencies have a limited supply. This prevents the release of additional assets and reduces the risk of inflation. For instance, Bitcoin can never exceed 21 million units, and it remains one of the most popular and expensive assets today.

Currently, digital assets are not considered reliable investment tools because their prices are difficult to predict due to numerous influencing factors. Even statements from famous personalities can significantly affect the price.

Despite this, cryptocurrency is gaining popularity every year. Today, digital currencies can be used for payments in various organizations such as Microsoft, Steam, WordPress, Bloomberg, Wikipedia, Subway, and others. Digital currency can be exchanged or traded on special platforms.

The crypto market is a relatively new phenomenon. If you want to explore it or start earning with cryptocurrency, it is important to understand key terms and tools. One such tool is funding. This article explains what funding in cryptocurrency is and how it helps generate profit in the crypto market.

What is funding in crypto trading?

Funding in cryptocurrency is a price-balancing mechanism applied to perpetual futures. Its purpose is to ensure that the price of perpetual contracts does not diverge too much from the price of the underlying assets in the spot market. For example, it keeps the price of ETH/USDT futures close to the price of ETH on the spot market.

Traders pay a specific funding rate, which can be paid to either long or short traders, depending on market conditions. Some traders use this mechanism for profit, earning not only from trading but also from the funding rate itself.

What is the role of funding?

Now that we understand what funding in cryptocurrency is, let us see how it is used in trading.

Funding ensures there is no significant price difference between perpetual futures and the underlying assets. This system, known as "funding," helps balance the fluctuating prices of perpetual contracts and brings them closer to spot prices.

For traders, funding represents the cost of holding a position, while for exchanges, it helps balance asset prices.

The funding rate is not a trading fee. It is paid by some traders to others. On certain exchanges, the rate includes a fixed percentage and a premium. For instance, Binance has a fixed rate of 0.01% every 8 hours for open trades, plus a premium, which is a variable rate depending on the deviation of the futures price from the spot price.

Usually, the funding rate is calculated as a small percentage of the position size. The percentage depends on how much the price deviates. Most often, the rate is applied hourly, every 4 hours, or every 8 hours. Trading fees are charged for certain actions, such as opening and closing positions. As long as the position remains open, interest is paid on it.

When the funding rate is positive, those holding long positions pay those who hold short positions. If the rate is negative, the reverse happens. For example, if you hold a short perpetual contract worth $5,000 at a negative funding rate, you will pay 0.0152% of $5,000 to a trader who holds a long position.

What affects funding?

Funding is influenced by the correlation between open positions in perpetual futures and the size of the difference between the price of the same asset in the futures and spot markets. Funding can be either positive or negative. The rate will be positive if the futures contract price is higher than the spot market price. If the opposite is true, the funding will be negative.

How does funding work?

When a trader holds a position in perpetual futures, they may encounter unexpected expenses related to the funding rate. If they have an open position in perpetual futures, they will either pay or receive a percentage based on the trade.

The funding rate eliminates price discrepancies between futures and the underlying asset. This rate is set several times a day. The mechanism takes a percentage from some traders and gives it to others.

If the futures price is significantly higher than the spot price, the funding will be positive. Long traders will then pay short traders a fee. Conversely, if the funding rate is negative, short traders will pay long traders.

Each exchange sets its own rules for how frequently the rate changes and the overall state of the cryptocurrency market also affects this.

Funding encourages certain groups of traders to take action, which helps stabilize the price of perpetual contracts.

If the futures price is much lower than the spot price, these actions push the price higher. If the contract trades above the spot price, the price must be pushed down. Positive funding encourages traders to open long positions, raising the derivative's price. Negative funding on short positions deducts a percentage from sellers, which is paid to buyers, reducing the seller’s profits. This situation encourages shorts to close their positions, reducing pressure on the contract and helping the price rise closer to the spot price.

Negative funding works similarly. When a trader opens a long position, they lose part of their profit in favor of sellers. This motivates sellers and discourages buyers.

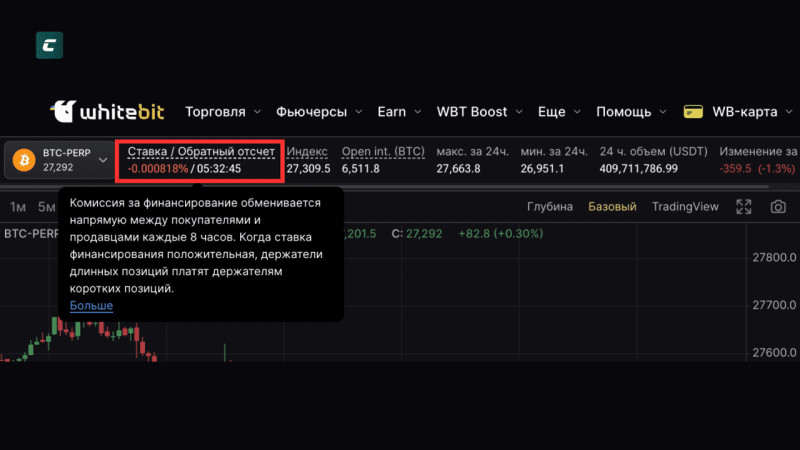

It is important for traders to constantly monitor the funding rate. Holding open positions can be expensive when the rate is high. The funding rate can be tracked through the exchange's interface or via the trading tool’s card.

Trading futures

Currently, one of the most popular tools for trading is perpetual futures contracts. These are available on many cryptocurrency exchanges and are gaining increasing popularity. They track the price of cryptocurrencies and other digital assets. Unlike standard futures, perpetual contracts can be held indefinitely and allow the use of leverage. This type of derivative has proven effective in the cryptocurrency market.

However, trading perpetual futures is quite risky. Therefore, some countries require exchanges to regulate the leverage size and insist that users undergo testing before they can start trading perpetual contracts.

What is open interest and how can one use it in trading?

If the rate field is highlighted in orange, those holding long positions will pay an annual rate of 100% on the open position. As mentioned earlier, in the example of the trader, they would need to pay $500,000 per year to maintain the open position with that leverage. If the field turns green, this means funding is approaching its minimum. With a purple field, the trader holding the position will receive a percentage from those in short positions.

Those who open long positions are usually fine with high funding rates since if their asset's price rises quickly, their earnings will cover these payments.

But they can also lose their funds if the asset price drops significantly or volatility is lacking. Prolonged stagnation pushes traders to close their positions, which affects the market.

In addition, if a stop-loss is triggered, the trader could be forced to become a seller. If the asset price falls and they lack funds to handle the drop, liquidation will occur. Mass closures of positions can significantly impact the market.

This is why cryptocurrency assets can experience sharp price drops, sometimes of 10–50%, even during bullish periods. In such cases, funding rates often increase dramatically.

Always pay attention to the funding rate heatmap. For example, an orange cell signals an increased risk of a particular asset's crash. It is wise to avoid impulsive cryptocurrency purchases during these times, as it is not a safe moment.

There are services that allow real-time tracking of funding rates, shown as heatmaps. They also display annual funding rates for different assets and how they have changed over time. For convenience, you can sort them by open interest, for example.

Funding in market analysis

The funding reflects market sentiment. A high and positive rate indicates the dominance of bulls, while a low and negative rate shows bears are in control.

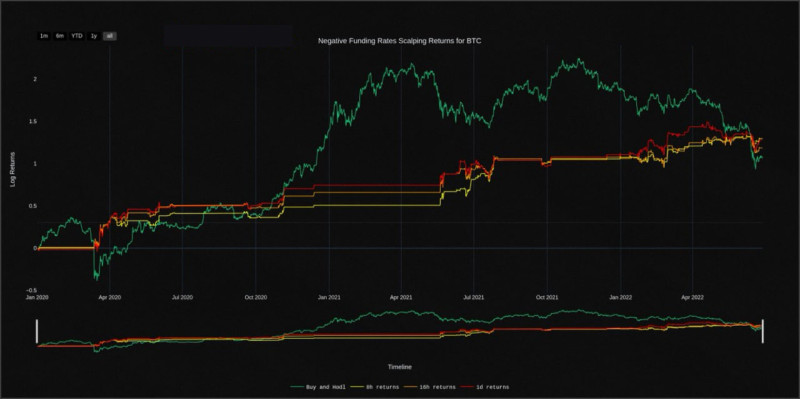

You can incorporate funding into your trading strategy and align it with the overall trend. We already know that when funding is positive, it makes sense to take a short position, and when it is negative, it is better to go long.

But how can it be combined with the trend?

Sometimes, funding and the current trend contradict each other. For instance, if there is a clear downtrend on the chart, but funding is positive, it indicates weak bulls. In such a case, it is better to open a short position to earn payouts from sellers. Conversely, in an uptrend with a negative rate, it is better to go long, signaling weak bears and potential earnings from them.

Always monitor funding closely, as losses can occur otherwise. Some platforms offer funding bots for convenience.

How to profit from funding

We have covered what funding is in cryptocurrency. Now, let us explore how to earn from it. One way is through delta-neutral trading. This strategy allows traders to profit from the price difference between the asset and its future. It involves opening and closing positions at the right times to collect funding.

Funding is visible to all market participants, who actively respond to it. There are two main ways to make money from funding:

- Profit from asset stabilization. You can earn by opening a position to stabilize an asset’s price, for which the system will reward you. To enter the trade, you must do so before the funding is distributed. If the funding is positive, you should take a long position; if it is negative, go short. On Binance, for example, funding is redistributed every 8 hours.

- Profit from price changes. This involves earning from the price movements caused by funding rates. Players may open short positions before negative funding is credited, resulting in active bearish behavior before the funding calculation. The future market situation depends on the subsequent funding rate. If it becomes positive, we might see a sharp rise in asset prices due to mass short-covering. If it remains negative, expect a further price drop.

These approaches work when no other major market factors are present. If there are other influencing factors, a trader’s actions will hardly affect the situation.

Arbitrage

Arbitrage is a strategy where traders simultaneously trade on multiple exchanges, capturing the difference in funding rates for the same asset.

For example, the funding rate on one exchange is 0.05%, while on another, it is 0.03%, for the same cryptocurrency. The rate is paid out at different times, depending on the exchange. Over time, long traders pay short traders on one exchange, and vice versa on the other. Here is an example:

We have two exchanges, Exchange 1 and Exchange 2. Our account balance is $10,000, which we will trade, assuming a constant rate for the day.

On Exchange 1

With a positive funding rate, we take a short position worth $5,000. Without leverage, the daily profit will be $7.5 (5,000 x 0.05%) x 3 = $7.5. If you use leverage, multiply the resulting amount.

On Exchange 2

With a negative rate, we open a long position with $5,000. Without leverage, the profit will be $4.5 (5,000 x 0.03%) x 3 = $4.5. Always take into account the commission.

Hedging

You can hedge futures with spot positions. To do this, buy a cryptocurrency asset on the spot market and trade it with the same amount on the perpetual market.

For example, you have $23,200. On the spot market, BTC is priced at $20,000, while the perpetual market trades it at $23,000. You buy one BTC for $20,000 on the spot market and simultaneously enter a short position for $3,200 with 20x leverage on futures. One position hedges the other against volatility. Assuming funding is paid every 8 hours at 0.05% daily, the profit would be:

- Without leverage — ($3,200 x 0.05%) x 3 = $4.8, excluding commission.

- With 20x leverage — $96, excluding commission.

Always consider the risk of liquidation when trading derivatives. Follow trading rules and stick to your strategy.

Steps to earn from funding

Knowing what funding is in cryptocurrency is only half the battle. Any theory is only useful when you put it into practice. Here is how to earn from funding in 9 steps:

- Register on a trading platform.

- Deposit funds into your trading account.

- Choose an asset to work with.

- Check the current funding rate.

- Open a long or short position for the amount you selected. It is advisable to use an isolated margin with 1x leverage.

- Stay in the position until the trend changes. Wait for funding to flip.

- Close your position.

- Convert your profit to stablecoins.

- Calculate your earnings.

How to prevent liquidation in futures trading

First, determine the amount you are willing to lose. Remember that trading carries certain risks, including liquidation. No strategy can guarantee earnings or prevent losses. However, some tools and rules can help protect your deposit from liquidation.

Tools and rules:

- Liquidation calculator: This tool estimates the asset price at which liquidation could occur.

- Avoid high leverage: While it allows for quick gains, the risks are high. Small price changes can wipe out your deposit. Trading with high leverage is risky.

- Use stop-loss: A stop-loss automatically closes your trade at a specific price if the market moves against you. Set it above the liquidation price.

Conclusion

Funding in cryptocurrency is a useful tool for market analysis that simplifies trading. It helps traders optimize strategies and avoid unnecessary liquidation. Funding is an excellent choice for effective work in the cryptocurrency market.

Back to articles

Back to articles