Analysis of Trades and Trading Tips for the British Pound

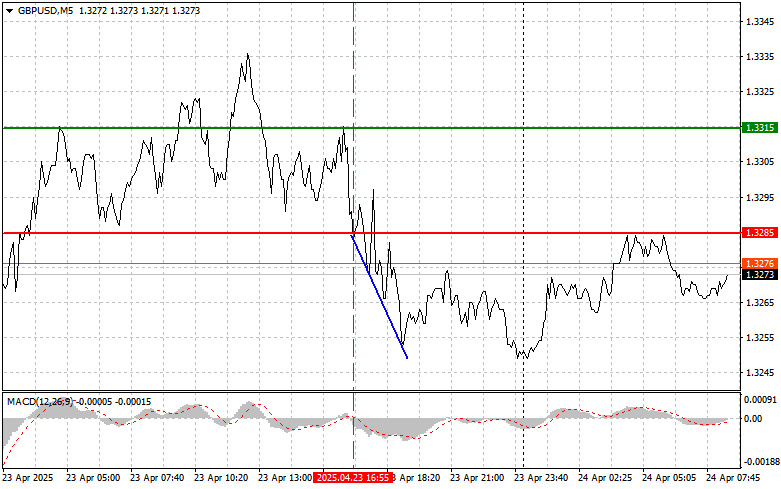

The price test at 1.3285 occurred when the MACD indicator had just started to move down from the zero mark, confirming a valid entry point for selling the pound. As a result, the pair dropped by more than 30 pips.

Demand for the US dollar returned in the second half of the day yesterday, supported by strong data on US manufacturing and services activity. The PMI index for the manufacturing sector exceeded analysts' expectations, indicating a recovery in production growth in the country. Simultaneously, the services sector also showed resilience, reinforcing the overall picture of economic strength. These macroeconomic figures supported the US dollar, which had been under pressure for most of the day.

Today, the economic calendar includes the release of the Industrial Order Balance report from the Confederation of British Industry. This report is important for assessing the current state of the British economy and serves as a leading indicator of future business activity. Analysts closely examine changes in order volumes to determine whether demand for UK industrial goods is rising or falling. An increase in orders usually indicates positive prospects for production, employment, and investment, whereas a decline could signal impending challenges. Strong results may offer limited support for the pound, but only if they significantly exceed economists' forecasts.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Buy Signal

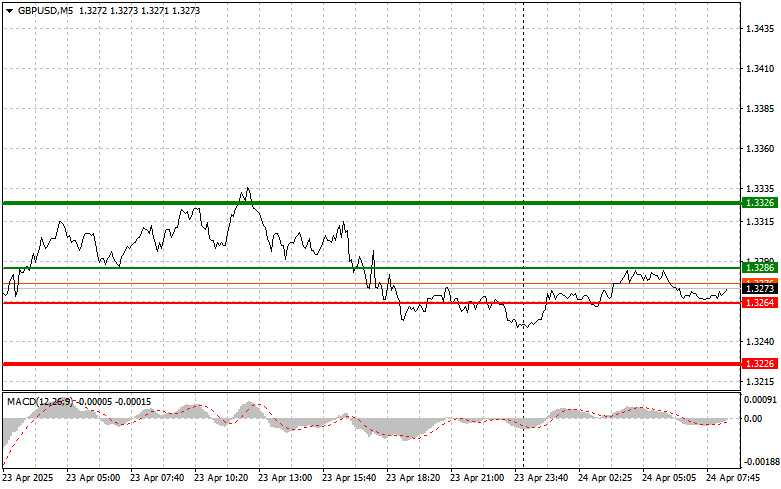

Scenario #1: I plan to buy the pound today if the entry point 1.3286 (green line) is reached, with the target set at 1.3326 (thicker green line on the chart). Around 1.3326, I intend to exit the long position and open short positions in the opposite direction (anticipating a move of 30–35 pips from the entry point). The pound is likely to grow today only if strong economic data is released.

Important! Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3264 level when the MACD indicator is in the oversold area. This would limit the pair's downside potential and trigger an upward reversal. A rise toward the opposite levels of 1.3286 and 1.3326 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout of the 1.3264 level (red line on the chart), which could lead to a quick drop in the pair. The key target for sellers will be the 1.3226 level, where I intend to exit short positions and immediately open long positions in the opposite direction (anticipating a move of 20–25 pips from the level). Selling the pound is viable after weak data.

Important! Before selling, make sure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3286 level when the MACD indicator is in the overbought area. This would limit the pair's upside potential and trigger a downward reversal. A decline toward the opposite levels of 1.3264 and 1.3226 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.