Trade Review and Trading Tips for the British Pound

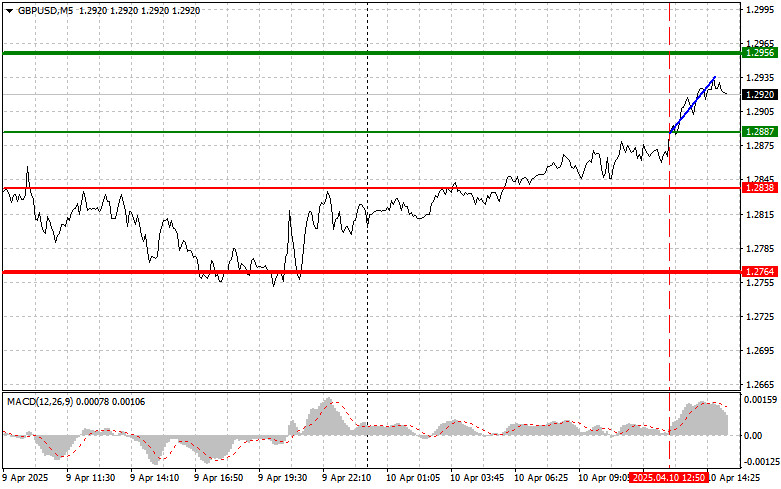

The price test at 1.2887 occurred when the MACD indicator had just begun to move upward from the zero line, confirming a valid entry point for buying the pound. As a result, the pound rose by 40 points.

Despite the absence of significant economic data from the UK, the British pound continued to strengthen. Statements from Bank of England officials had little impact on the currency, as markets were encouraged by the U.S. decision to suspend trade tariffs. This decision was a clear relief for the British economy, which has faced challenges recently. Investors interpreted the news as a sign of improved trade prospects and reduced import pressure, positively impacting the pound's value. However, it is important to note that such optimism may be short-lived. The real effect of tariff suspensions on the UK economy will only be seen if Trump fully abandons them.

In the second half of the day, pressure on the pound may return due to the expected release of key U.S. consumer price index (CPI) data for March, as well as several speeches from Federal Reserve officials. Investors will closely watch these events to gauge the outlook for future Fed monetary policy and its potential influence on the U.S. dollar. Rising U.S. inflation could prompt the Fed to adopt a more aggressive tightening stance, which would strengthen the dollar and weigh on other currencies, including the pound. Conversely, softer inflation figures could weaken expectations for Fed action and support the pound.

Speeches by Fed members will also be scrutinized for clues about future interest rate decisions and the path of quantitative tightening. Any signals about a faster or slower pace of policy tightening could significantly impact currency markets.

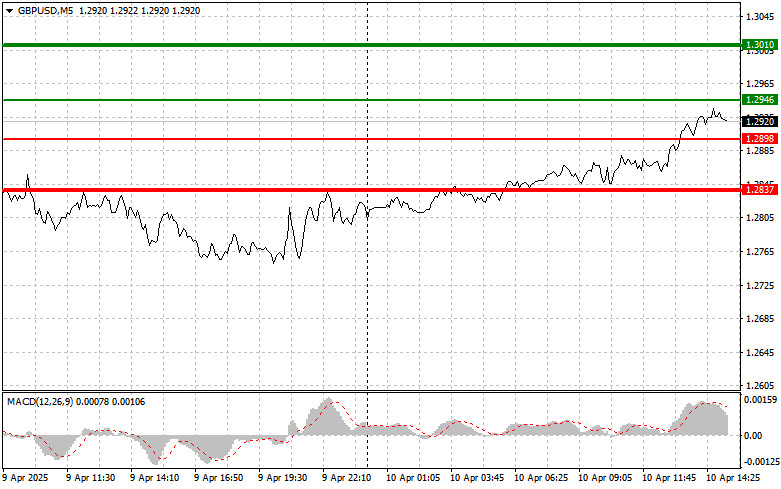

Regarding intraday strategy, I will focus on executing scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today at the entry point around 1.2946 (green line on the chart), targeting a rise to 1.3010 (thicker green line). At 1.3010, I plan to exit long positions and open shorts in the opposite direction (expecting a 30–35 point move back from this level). Pound growth today is more likely if U.S. inflation data turns out weak. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2898 level, with the MACD in the oversold zone. This would limit the pair's downward potential and lead to a bullish reversal. A rise toward the opposite levels at 1.2946 and 1.3010 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a break below the 1.2898 level (red line on the chart), which would lead to a quick decline in the pair. The key target for sellers will be 1.2837, where I plan to exit short positions and open longs in the opposite direction (expecting a 20–25 point bounce). Sellers will gain momentum in case of strong U.S. data. Important! Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2946 level, with the MACD in the overbought zone. This would limit the pair's upward potential and lead to a bearish reversal. A drop toward the opposite levels of 1.2898 and 1.2837 can be expected.

Chart Legend:

- Thin green line – entry price for buying the trading instrument

- Thick green line – suggested Take Profit level or manual profit-taking area, as further growth beyond this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – suggested Take Profit level or manual profit-taking area, as further decline below this level is unlikely

- MACD Indicator – when entering the market, it's important to follow overbought and oversold zones

Important Note: Beginner Forex traders must exercise great caution when making entry decisions. It is best to stay out of the market ahead of major fundamental releases to avoid being caught in sharp price swings. If you choose to trade during news events, always place stop-loss orders to minimize potential losses. Without stop-losses, you risk quickly losing your entire deposit, especially if you don't practice money management and trade with large positions.

And remember: for successful trading, you need a clear trading plan — like the one I've outlined above. Making spontaneous trading decisions based on the current market situation is a losing strategy for any intraday trader.