The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally changed. In recent days this week, the euro has been trading strictly sideways within the horizontal channel of 1.1274–1.1391. Since the pair approached the upper boundary of this channel before the ECB meeting, a decline in the euro was quite predictable regardless of the central bank's decision. Even with these initial conditions, the euro didn't lose much, and the dollar didn't gain much.

There is no point in discussing any other macroeconomic events starting Thursday. The market ignored the ECB meeting results, and it's not even accurate to say that it had priced them in advance. It's worth recalling that monetary policy easing is a bearish factor for a national currency. The euro would have fallen all week if the market had started pricing in a rate cut. Instead, it remained in a flat range, meaning there was no front-running. All other macroeconomic releases had close to zero chance of affecting market sentiment.

The market continues to wait for news from the White House. It's evident to everyone that Trump has not stopped lashing out and accusing the world of robbing the U.S., so there is no doubt that we will see new tariffs. Soon, China may be the next target, with tariffs possibly rising to 245%. As mentioned, any tariffs above 100% would effectively halt trade between the U.S. and China. This is well understood in Beijing, which is why Chinese officials have already stated that they will not be raising tariffs further — because it simply makes no sense. Trump could impose 1000% of the duties if he wanted, but China wouldn't back down or blindly follow orders from the White House.

So, the key takeaway from this conflict today is that China does not intend to dance to Donald Trump's tune. And that is critical because it essentially eliminates any realistic chances of a near-term agreement between the two countries. However, Beijing's position might also be more strategic — they could be waiting for domestic upheaval in the U.S. Let's not forget the ongoing protests and demonstrations across America personally targeting Trump while Democrats prepare a third attempt at impeachment. China may be betting on the American public turning against Trump, as they will suffer most from the trade war: no more cheap Chinese goods and rising prices for alternatives, while wages remain the same. In this context, China may be waiting for it while Trump tells the world not to deal with China. The American circus continues its tour.

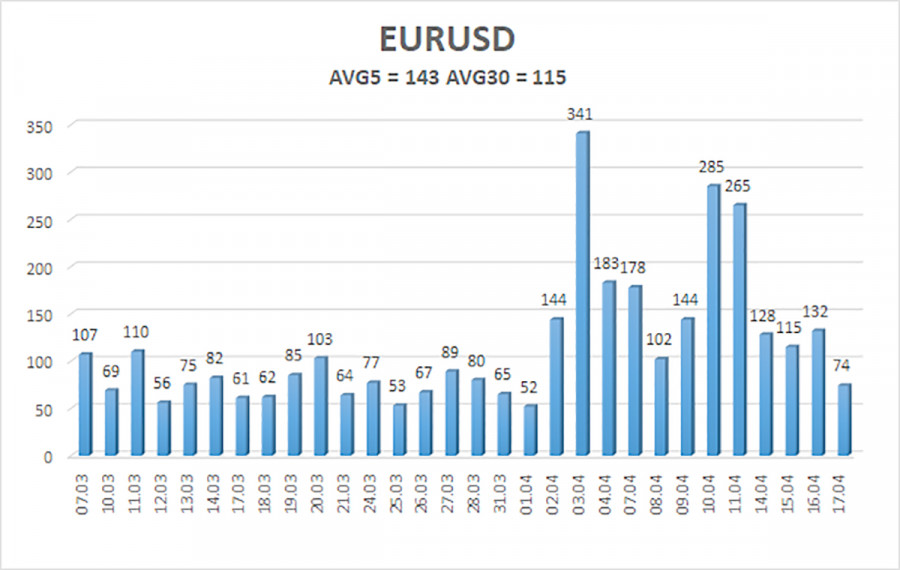

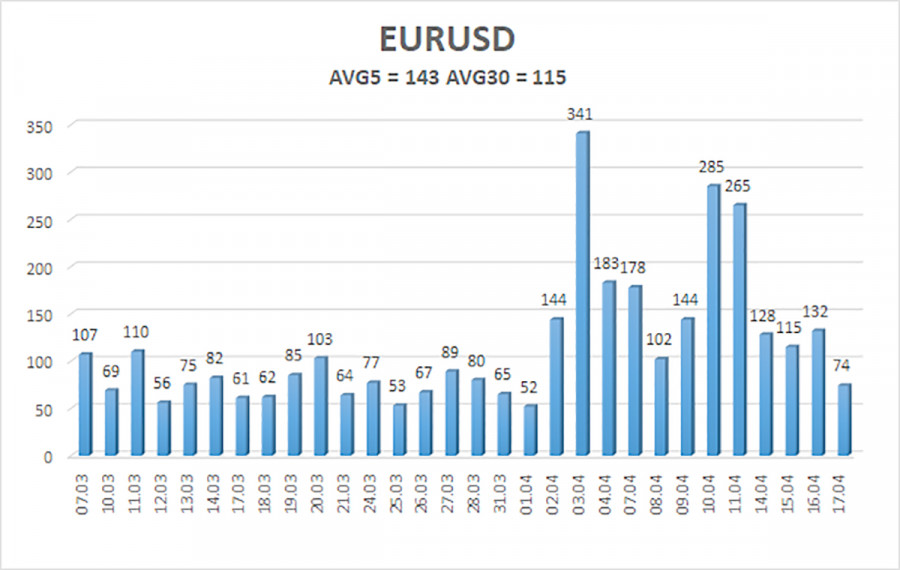

The average volatility of the EUR/USD pair over the last five trading days, as of April 18, stands at 143 pips, which is considered "high." We expect the pair to move from 1.1227 to 1.1513 on Friday. The long-term regression channel is directed upward, indicating a short-term uptrend. The CCI indicator has entered overbought territory twice, once again signaling a potential correction. A bearish divergence has also formed. However, the dollar could resume its decline at any moment, and the euro shows no urgency to fall.

Nearest Support Levels:

S1 – 1.1353

S2 – 1.1230

S3 – 1.1108

Nearest Resistance Levels:

R1 – 1.1475

Trading Recommendations:

The EUR/USD pair remains in an upward trend. For months, we've consistently said we expect a medium-term decline in the euro, and nothing has changed in that outlook. The dollar still has no fundamental reason for medium-term weakness — except for Donald Trump. Yet that one factor continues to drag the dollar down. Moreover, it's now completely unclear what long-term economic consequences this may bring. By the time Trump calms down, the U.S. economy might be in a dire state — and in that case, any talk of a dollar recovery would be meaningless.

If you're trading based purely on technicals or "the Trump factor," then long positions may be considered as long as the price remains above the moving average, with targets at 1.1475 and 1.1513.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.